Get Hi Dot N-20 - Schedule K-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT N-20 - Schedule K-1 online

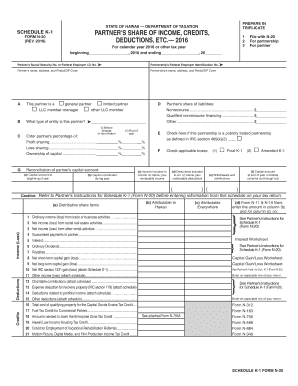

The HI DoT N-20 - Schedule K-1 is an essential document for reporting a partner's share of income, credits, deductions, and other relevant financial information. This guide will provide you with clear, step-by-step instructions on how to complete this form online, ensuring accuracy and compliance with tax requirements.

Follow the steps to successfully complete the HI DoT N-20 - Schedule K-1 online.

- Press the ‘Get Form’ button to retrieve the form and open it in the online editor.

- In the first section, fill in the calendar year or other tax year for which the form applies. Ensure you enter the beginning and ending dates correctly.

- Indicate the type of partner by selecting the appropriate checkbox (general partner, limited partner, LLC member-manager, or other LLC member).

- For the reconciliation of the partner’s capital account, fill in the capital account at the beginning of the year and any capital contributed during the year.

- Check the box if this partnership is a publicly traded partnership as defined in IRC section 469(k)(2).

- Proceed to fill out the credits, deductions, and income sections by entering the distributive share items and indicating the amounts attributable to Hawaii.

Complete your HI DoT N-20 - Schedule K-1 online today for a seamless filing experience.

Get form

Related links form

You should mail Form N-20 to the address specified on the form for the Department of Taxation. Be sure to include any associated documents like your HI DoT N-20 - Schedule K-1 for complete submissions. Correctly mailing your form ensures that you meet filing deadlines and helps in the quick processing of your tax documents. Check the Hawaii Department of Taxation website for any updates on mailing addresses.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.