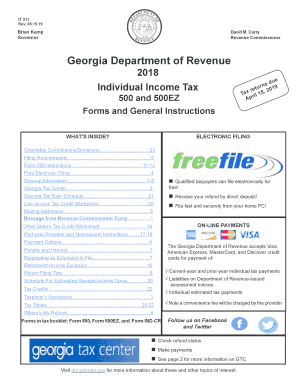

Get Ga It 511 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign GA IT 511 online

How to fill out and sign GA IT 511 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Recording your earnings and submitting all the essential tax documents, including GA IT 511, is a US citizen's exclusive obligation.

US Legal Forms makes your tax management considerably more accessible and precise.

Store your GA IT 511 securely. Ensure that all your relevant documents and information are correctly organized while considering the deadlines and tax regulations established by the Internal Revenue Service. Simplify it with US Legal Forms!

- Obtain GA IT 511 in your web browser from your device.

- Open the editable PDF file with a click.

- Begin filling out the online template field by field, adhering to the prompts of the advanced PDF editor's interface.

- Accurately input textual data and figures.

- Click the Date box to automatically insert the current date or modify it manually.

- Utilize Signature Wizard to create your unique e-signature and verify in moments.

- Consult Internal Revenue Service guidelines if you still have any uncertainties.

- Press Done to save the updates.

- Continue to print the document, download, or send it via Email, text, Fax, or USPS without leaving your web browser.

How to amend Get GA IT 511 2019: personalize forms online

Authorize and distribute Get GA IT 511 2019 along with any additional business and personal documents online without squandering time and resources on printing and mail delivery. Maximize the use of our online form editor with an integrated compliant electronic signature feature.

Sanctioning and submitting Get GA IT 511 2019 files electronically is quicker and more effective than handling them on paper. However, it necessitates employing online tools that guarantee a high degree of data security and furnish you with a compliant resource for creating eSignatures. Our powerful online editor is exactly what you require to prepare your Get GA IT 511 2019 and other personal and business or tax forms accurately and appropriately in adherence to all the stipulations. It includes all the essential resources to swiftly and effortlessly complete, alter, and endorse documentation online and insert Signature areas for others, indicating who and where should sign.

Completing and signing Get GA IT 511 2019 online only takes a few straightforward steps:

Distribute your documents to others using one of the available methods. When approving Get GA IT 511 2019 with our all-encompassing online solution, you can always be assured of obtaining it legally binding and admissible in court. Prepare and submit documents in the most effective manner possible!

- Access the chosen document for further manipulation.

- Utilize the top toolkit to incorporate Text, Initials, Image, Check, and Cross indicators to your template.

- Highlight the most crucial aspects and obscure or remove sensitive information if required.

- Click on the Sign option above and select how you wish to eSign your document.

- Sketch your signature, type it, upload an image of it, or select an alternative method that fits your needs.

- Transition to the Edit Fillable Fields section and place Signature zones for others.

- Click on Add Signer and input your recipient’s email to assign this zone to them.

- Ensure that all information provided is complete and accurate before you click Done.

Get form

Filling out a withholding allowance form requires you to provide pertinent personal details, such as your Social Security number and filing status. Indicate your desired number of allowances based on your financial situation. For additional support, resources related to GA IT 511 can guide you through the completion process efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.