Loading

Get Equitrust Et-2532 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EquiTrust ET-2532 online

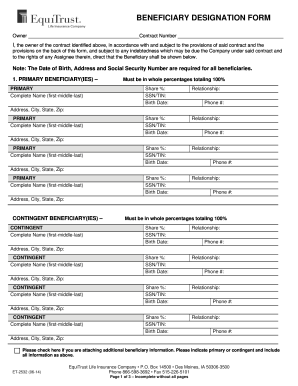

Filling out the EquiTrust ET-2532 Beneficiary Designation Form online can simplify the process of designating beneficiaries. This guide provides a step-by-step approach to ensure that you complete the form accurately and efficiently.

Follow the steps to efficiently complete the form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by filling in the owner's name and contract number at the top of the form. Ensure accurate spelling and details.

- In the 'Primary Beneficiary(ies)' section, provide the complete names of all primary beneficiaries. Each name must be listed in the order of their importance to you.

- For each beneficiary, fill out the share percentage, ensuring that the total equals 100%. Provide the Social Security Number (SSN) or Tax Identification Number (TIN), birth date, and relationship of each primary beneficiary to the owner.

- Repeat the same process for the 'Contingent Beneficiary(ies)' section, ensuring that you also list their complete names and information as done for the primary beneficiaries.

- If needed, check the box if you are attaching additional beneficiary information, specifying if they are primary or contingent.

- In the subsequent sections, if applicable, fill in details about a living trust as the primary beneficiary, providing the trustee's name, the name of the grantor, and the trust ID number.

- Finally, review the form for any required signatures, including the owner's and any additional signatures necessary if you reside in a community property state.

- Once everything is filled out, save your changes. You may choose to download, print, or share the completed form depending on your needs.

Complete your EquiTrust ET-2532 form online today for a streamlined beneficiary designation process.

A good interest rate for an annuity typically ranges from 3% to 5%, depending on the specific product and market conditions. For the EquiTrust ET-2532, it is essential to evaluate how the offered rates measure up to your retirement plans. Comparing these rates with other options empowers you to make informed decisions about your financial future.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.