Get Ga Dor It-wh 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR IT-WH online

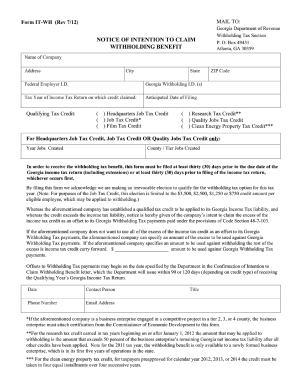

Filling out the GA DoR IT-WH form online can be a straightforward process if approached step by step. This guide will help you understand each component of the form and provide clear instructions to successfully complete it.

Follow the steps to complete the GA DoR IT-WH form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred digital editor.

- Begin by entering the name of your company in the designated field. Ensure that you provide the full legal name of the entity as recognized by tax authorities.

- Input the complete address of your company, including city, state, and ZIP code. Be certain that the details match the official records to avoid discrepancies.

- Provide the Federal Employer Identification Number (EIN) and the Georgia Withholding Identification Number(s) in their respective fields. This information is crucial for tax processing.

- Indicate the tax year for which you are claiming the credit. This should reflect the specific tax year corresponding to the income tax return.

- Choose the qualifying tax credit that applies to your situation by marking the appropriate checkbox. Options include Headquarters Job Tax Credit, Job Tax Credit, Film Tax Credit, Research Tax Credit, Quality Jobs Tax Credit, and Clean Energy Property Tax Credit.

- For the Headquarters Job Tax Credit, Job Tax Credit, or Quality Jobs Tax Credit, fill in the year jobs were created and the corresponding county or tier where these jobs were created.

- Note that this form should be submitted at least thirty (30) days prior to the due date of your Georgia income tax return or prior to filing the return, whichever comes first. Make sure you comply with this timeframe.

- Specify any amount from the tax credit that you wish to use against Georgia Withholding Tax payments if you do not intend to use the entire excess credit.

- Finalize the form by providing the date, contact person's details (name, title, phone number, and email address) in the relevant fields.

- After filling out all required fields, save your changes. You can then download, print, or share the completed form as needed.

Complete your GA DoR IT-WH form online today to ensure timely submission and maximize your tax benefits.

Get form

Related links form

When filling out your tax withholding form, start with accurate personal information like your name and Social Security number. Follow the specific instructions for your form, such as the GA DoR IT-WH, and ensure that you are claiming the correct number of allowances. For detailed help, many individuals turn to resources like uslegalforms, which can provide templates and expert advice for filling out these important tax forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.