Loading

Get Ga Dor It-app 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR IT-APP online

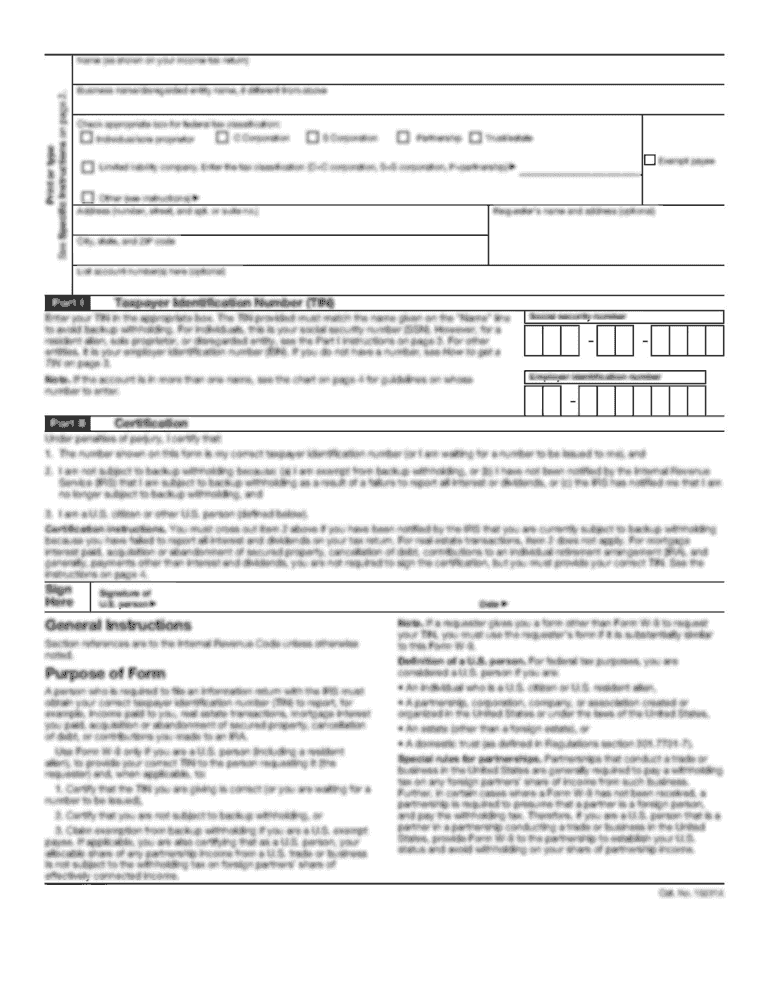

Filling out the GA DoR IT-APP is essential for claiming the manufacturer's investment tax credit in Georgia. This guide provides step-by-step instructions to help you navigate through the application process clearly and effectively.

Follow the steps to complete your application accurately.

- Click 'Get Form' button to obtain the form and open it in your chosen editor.

- Provide the required information about the manufacturing facility where the investment tax credit will be claimed. Include details such as Tax ID number, name, type of entity, address, phone number, city, state, zip code, county, county tier, years in which you intend to claim the credit, date of organization or incorporation, and whether you are a calendar year or fiscal year filer, along with your fiscal year end.

- Fill out the details regarding the taxpayer’s existing manufacturing facility or related manufacturing support facility that has been operating in Georgia for the last three years. Include the Tax ID number, name, date of organization or incorporation, address, phone number, and city.

- Complete the section concerning the taxpayer’s project. Specify the date the project commenced, the completion date (or estimated completion date if not finished), whether the taxpayer has claimed any related tax credits for this project, and if they are constructing a new facility or expanding an existing one.

- Attach a detailed narrative that describes the taxpayer's project plan. This should explain how the qualified investment property relates to the manufacturing operation.

- Provide information about the property purchased or acquired under the project plan. Indicate if it includes property that aids in the conversion from defense to domestic production, pollution control or prevention machinery, and recycling facilities. Attach necessary certifications and documentation as required.

- Attach a schedule listing all qualified investment property purchased or acquired. This should contain details such as type of property, quantity, purchase date, basis in property, fair market value of leased property, and capitalized cost.

- Finally, sign the application as the president or principal officer of the taxpayer. Include a typed name and contact details in the designated fields.

- Once all information is complete, save changes, download, print, or share the form as needed.

Complete your GA DoR IT-APP application online today to ensure you can claim your manufacturer's investment tax credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The GA DoR IT-APP is a legitimate resource designed to help Georgia residents manage their tax-related needs. Users can rely on its features for accurate information and helpful tools. Always confirm by checking the reviews and state endorsements to ensure trust in any platform.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.