Loading

Get Ga Dor Crf-002 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR CRF-002 online

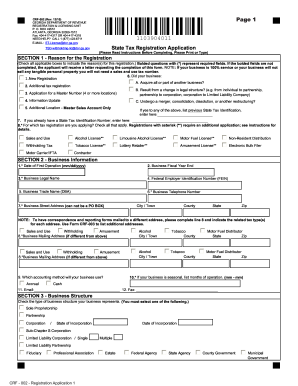

Filling out the GA DoR CRF-002 form is a crucial step in registering your business in Georgia. This guide provides clear and detailed instructions to help you complete the registration process successfully and accurately.

Follow the steps to complete the registration form effectively.

- Press the ‘Get Form’ button to obtain the registration form and open it in your preferred editor.

- In Section 1, indicate the reason for your registration by checking all applicable boxes. Remember that the bolded fields marked with an asterisk are required. If not completed, you will receive a letter requesting these details.

- In Section 2, provide essential business information including the date of first operation, business legal name, and business address. Ensure that the business street address does not include a P.O. Box.

- Continue to Section 3 to check the appropriate business structure. It is mandatory to select one of the provided options, such as sole proprietorship or partnership.

- In Section 4, list the owners, partners, and officers by providing their names and Social Security numbers or Individual Taxpayer Identification Numbers. The application will not be processed without this information.

- Navigate to Section 5 to explain the nature of your business and the products or services you will offer. Be sure to indicate percentages if your business combines different activities.

- In Section 6, answer whether your business will have employees. If yes, provide information regarding payroll responsibilities and expected withholding amounts.

- Finally, in Section 7, ensure an authorized signature is included along with contact information of the individual who prepared the form. This section confirms the accuracy of the application under penalties of perjury.

- After completing all sections, save your changes and prepare to download, print, or share the form as necessary.

Complete your registration documents online today to ensure a smooth business setup process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In Georgia, a Power of Attorney does not typically have to be filed with the court unless it involves specific proceedings or contexts. The form is generally submitted directly to the Georgia Department of Revenue for tax purposes. Check the GA DoR CRF-002 for additional requirements and guidelines regarding your situation. For comprehensive support and templates to create your POA, consider using USLegalForms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.