Loading

Get Sc Dor Sc1041 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1041 online

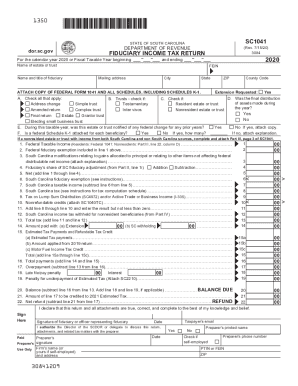

The SC DoR SC1041 form is essential for filing fiduciary income tax returns in South Carolina. This guide will provide step-by-step instructions to help you navigate the process and accurately complete the form online.

Follow the steps to fill out the SC DoR SC1041 online.

- Press the ‘Get Form’ button to acquire the SC DoR SC1041 form and open it in your online editor.

- Begin filling out the header section by entering the name of the estate or trust, the name and title of the fiduciary, the Federal Employer Identification Number (FEIN), the mailing address, city, state, zip code, and the county code.

- Mark the box for ‘Extension Requested’ if applicable. Next, check all applicable entries in section A which pertains to your form type, such as ‘Amended return’ or ‘Final return’.

- For line 1, enter the Federal Taxable Income. Residents should derive this amount from the Federal Form 1041, while nonresidents will need to use Part III, line 22, column D.

- Follow through the form entering various exemptions and modifications as indicated for each line, including South Carolina modifications, fiduciary's share of South Carolina adjustments, and taxable income calculations.

- Complete parts regarding any capital gains, nonrefundable credits, and other deductions as necessary on the specific lines outlined.

- Ensure that you declare any payments made with extension requests and fill out any sections specific to nonresident beneficiaries.

- After completing the form, review all data entered to confirm accuracy. Save changes to your form.

- Finally, download, print, or share the completed form as needed and ensure any required attachments are included.

Start filling out your SC DoR SC1041 online today to ensure compliance with South Carolina tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.