Loading

Get Mi Dot 4567 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 4567 online

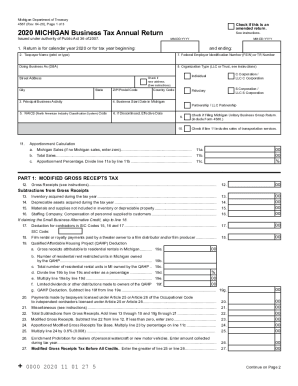

This guide provides comprehensive and user-friendly instructions for filling out the Michigan Department of Treasury Form 4567 online. This form is essential for calculating the Modified Gross Receipts Tax and Business Income Tax for standard taxpayers in Michigan.

Follow the steps to complete your MI DoT 4567 online form.

- Click the ‘Get Form’ button to obtain the MI DoT 4567 and open it in your preferred editor.

- Indicate the tax year for which you are filing in the designated field; provide the start and end dates if it's not for a calendar year.

- Enter your full taxpayer name, along with the Federal Employer Identification Number (FEIN) or TR Number. Include your business name if applicable.

- Fill in the organization type by checking the appropriate box for LLC, Corporation, or trust as applicable.

- Provide your business address. If your address has changed since your last filing, mark the box indicating a new address.

- Describe your principal business activity briefly, including the NAICS code that corresponds to your business.

- If your business has been discontinued, enter the effective date of discontinuation.

- Complete the apportionment calculation using your Michigan sales and total sales to determine the apportionment percentage.

- For Part 1: Modified Gross Receipts Tax, record your gross receipts and enter deductions where applicable. Take care to follow instructions related to each line item.

- Proceed to Part 2: Business Income Tax and provide the necessary income figures, including any additions or subtractions to your income as required.

- In Part 3, compute your Total Michigan Business Tax before credits by adding up the amounts from previous parts.

- Finally, review your form for any missed fields, save your changes, and proceed to download, print, or share your form as needed.

Complete your MI DoT 4567 online today to ensure compliance with Michigan tax regulations!

Related links form

Michigan's Corporate Income Tax (CIT) is at a flat rate of 6%. The tax applies to C Corporations and any entity that elects to be taxed as a C corporation. ... Flow-through entities pay no CIT, and income passes through to the owners' personal income tax (PIT) return. Michigan's current personal income tax rate is 4.25%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.