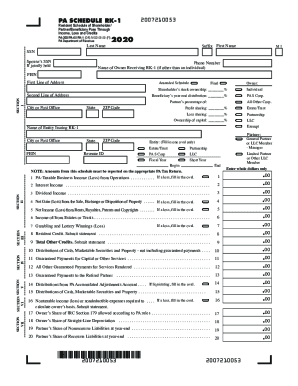

Get Pa Schedule Rk-1 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PA Schedule RK-1 online

How to fill out and sign PA Schedule RK-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The times of distressing complex legal and tax documents have ended. With US Legal Forms the process of filling out official documents is anxiety-free. The best editor is already close at hand providing you with multiple useful instruments for completing a PA Schedule RK-1. These tips, with the editor will guide you with the complete procedure.

- Hit the Get Form button to begin modifying.

- Activate the Wizard mode on the top toolbar to get additional tips.

- Complete each fillable field.

- Make sure the info you fill in PA Schedule RK-1 is updated and accurate.

- Include the date to the sample with the Date function.

- Click the Sign button and create an electronic signature. You can find three available options; typing, drawing, or capturing one.

- Re-check every field has been filled in correctly.

- Select Done in the top right corne to save the file. There are many choices for getting the doc. As an instant download, an attachment in an email or through the mail as a hard copy.

We make completing any PA Schedule RK-1 more straightforward. Start now!

How to edit PA Schedule RK-1: customize forms online

Put the right document management tools at your fingertips. Execute PA Schedule RK-1 with our reliable tool that comes with editing and eSignature functionality}.

If you want to execute and certify PA Schedule RK-1 online without hassle, then our online cloud-based option is the way to go. We offer a wealthy template-based library of ready-to-use forms you can modify and fill out online. In addition, you don't need to print out the document or use third-party solutions to make it fillable. All the necessary tools will be readily available at your disposal once you open the file in the editor.

Let’s go through our online editing tools and their key functions. The editor has a intuitive interface, so it won't require a lot of time to learn how to use it. We’ll take a look at three major sections that allow you to:

- Edit and annotate the template

- Arrange your documents

- Prepare them for sharing

The top toolbar comes with the tools that help you highlight and blackout text, without photos and image factors (lines, arrows and checkmarks etc.), sign, initialize, date the document, and more.

Use the toolbar on the left if you wish to re-order the document or/and delete pages.

If you want to make the template fillable for other people and share it, you can use the tools on the right and insert various fillable fields, signature and date, text box, etc.).

Aside from the functionality mentioned above, you can shield your file with a password, add a watermark, convert the document to the required format, and much more.

Our editor makes modifying and certifying the PA Schedule RK-1 a breeze. It allows you to make just about everything concerning dealing with forms. In addition, we always make sure that your experience modifying documents is secure and compliant with the main regulatory criteria. All these aspects make using our solution even more pleasant.

Get PA Schedule RK-1, make the necessary edits and tweaks, and download it in the desired file format. Give it a try today!

Related links form

Individuals filing declarations must use the PA-40 ES (I), Declaration of Estimated Personal Income Tax, to make payments of estimated taxes. Failure to receive forms does not relieve taxpayers from filing and paying the tax. Enter the due date of the estimated tax payment.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.