Loading

Get Md Comptroller Mw506a 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller MW506A online

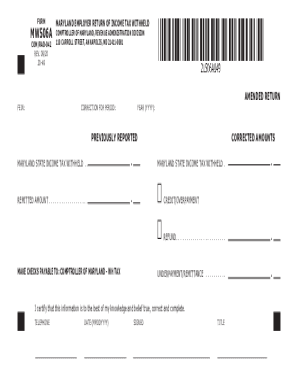

This guide provides a comprehensive overview for users on how to effectively complete the Maryland Employer Return of Income Tax Withheld (MW506A) online. Whether you are submitting a new return or amending an existing one, this step-by-step manual will assist you in accurately filling out the form.

Follow the steps to complete your MW506A form with ease.

- Click ‘Get Form’ button to obtain the MW506A form and open it in your preferred online editor.

- Enter the Federal Employer Identification Number (FEIN) in the designated field at the top of the form. Ensure that this number is accurate to prevent any issues with your submission.

- Indicate the correction period by entering the relevant dates or periods for which the correction is being made. If this is an amended return, be sure to check the box marked 'Amended Return.'

- Provide the year for which you are filing the return by entering it in the 'Year (YYYY)' field. This is crucial for processing your document correctly.

- In the section labeled 'Previously Reported,' fill in the amount of Maryland State Income Tax Withheld that was initially reported. Ensure that this reflects your earlier submission.

- Next, specify the amount that was remitted by entering it in the corresponding field. This should match the amount you actually paid.

- In the 'Corrected Amounts' section, enter the updated figures for Maryland State Income Tax Withheld. Ensure that these amounts reflect any changes you are reporting.

- Indicate any credit or overpayment in the designated field, if applicable. This will be essential in helping you manage your tax obligations.

- If you are requesting a refund, fill out the 'Refund' field with the specific amount you are claiming back.

- For any underpayment or remittance amounts, fill in the required fields accurately to provide complete information.

- Certify the accuracy of your information by filling in your telephone number, the date of submission, and your signature in the respective fields. Include your title if applicable.

- Finally, after reviewing all the information for accuracy, you can save your document, download a copy, print it, or share it as needed.

Take action now by filling out your MW506A form online for accurate and timely tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

State income tax (SIT) State income tax (SIT) is withheld from employee earnings each payroll. It is calculated using the following information: The amount earned. Employee's marital status.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.