Get Nm Trd Trd-31109 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

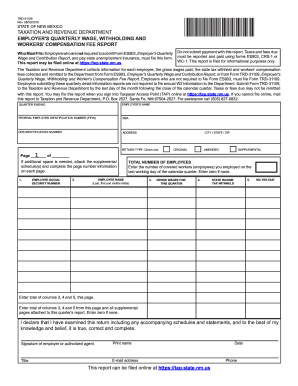

Tips on how to fill out, edit and sign NM TRD TRD-31109 online

How to fill out and sign NM TRD TRD-31109 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, the majority of Americans prefer to handle their own tax returns and also opt to complete documents online.

The US Legal Forms web platform facilitates the e-filing of the NM TRD TRD-31109 in a quick and easy manner. It now takes no more than 30 minutes, and you can accomplish it from anywhere.

Ensure that you have correctly completed and submitted the NM TRD TRD-31109 on time. Consider any deadlines. Providing incorrect information in your tax documents may lead to significant penalties and complications with your annual tax return. Always use reliable templates from US Legal Forms!

- Access the PDF template in the editor.

- Identify the highlighted fillable fields where you can enter your information.

- Select the option if you notice the checkboxes.

- Explore the Text tool and other advanced capabilities to manually adjust the NM TRD TRD-31109.

- Verify all details before proceeding to sign.

- Create your personalized eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

- Authenticate your online document and specify the exact date.

- Click on Done to continue.

- Store or forward the document to the intended recipient.

How to modify Get NM TRD TRD-31109 2016: personalize forms online

Locate the suitable Get NM TRD TRD-31109 2016 template and adjust it immediately. Streamline your documentation with an intelligent document modification solution for online forms.

Your daily routine with documents and forms can be more efficient when you have everything you require in a single location. For instance, you can discover, acquire, and modify Get NM TRD TRD-31109 2016 in one browser tab. If you need a particular Get NM TRD TRD-31109 2016, you can swiftly locate it using the intelligent search engine and access it right away. There is no need to download it or search for an external editor to alter it and input your information. All the tools for productive work come in one comprehensive solution.

This modification solution enables you to customize, complete, and endorse your Get NM TRD TRD-31109 2016 form directly on the spot. Once you identify a suitable template, click on it to initiate the editing mode. Once you launch the form in the editor, you have all the necessary tools at your disposal. You can effortlessly fill in the specified fields and delete them if required using a straightforward yet versatile toolbar. Apply all changes immediately, and sign the form without leaving the tab by simply clicking the signature area. Following that, you can send or print your document if needed.

Make additional custom modifications with the available tools.

Uncover new possibilities in streamlined and straightforward documentation. Find the Get NM TRD TRD-31109 2016 you need within minutes and complete it in the same tab. Eliminate chaos in your documentation for good with online forms.

- Annotate your document using the Sticky note feature by placing a comment at any location within the document.

- Incorporate necessary graphic elements, if needed, with the Circle, Check, or Cross tools.

- Alter or insert text anywhere in the document using Texts and Text box features. Add details with the Initials or Date tools.

- Adjust the template text with the Highlight and Blackout, or Erase tools.

- Insert custom graphic elements with the Arrow and Line, or Draw tools.

To determine your withholding tax rate, start with the Form W-4 your employer provided, as it includes relevant calculations. Additionally, you can consult the New Mexico Taxation and Revenue Department's resources. Familiarizing yourself with documents like NM TRD TRD-31109 will provide clarity on your specific situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.