Loading

Get Ca Ftb 3519 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3519 online

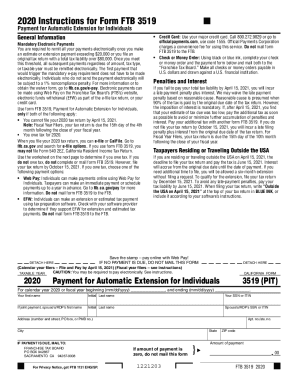

Completing the CA FTB 3519 form online is a straightforward process that allows you to manage your tax extension payments efficiently. This guide will walk you through each step to ensure you fill out the form correctly, avoiding potential penalties.

Follow the steps to successfully fill out the CA FTB 3519 online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Enter your personal information in the specified fields. Provide your first name and last name, followed by your social security number (SSN) or individual taxpayer identification number (ITIN). If filing jointly, include your partner's first name, last name, and SSN or ITIN.

- Complete the address section with your current residence details. This includes providing the number and street, apartment or suite number, city, state, and ZIP code.

- In the taxable year section, select 2020 as the year for which you are requesting the extension.

- Determine the amount of payment you owe. Use the worksheet provided to calculate the total tax you expect to owe and the corresponding payments and credits. Enter the amount due in the designated field.

- Review your entries for accuracy. Ensure all fields are properly filled and double-check your calculations.

- Once you have completed the form, you may choose to save your changes, download a copy for your records, or print the form for submission based on your chosen payment method.

- After filling out the form, make your payment electronically using one of the accepted methods, or follow the instructions for check or money order payments if applicable. Remember: do not mail the form if no payment is due.

Start filling out your CA FTB 3519 form online today to ensure a smooth tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The extension gives taxpayers until Oct. 15 to file, but taxes owed are due by July 15. The July 15 due date generally applies to all taxpayers who have an income tax filing or payment deadline falling on or after April 1, 2020, and before July 15, 2020. ... The IRS encourages taxpayers to file electronically.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.