Loading

Get Wi Pw-1 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI PW-1 online

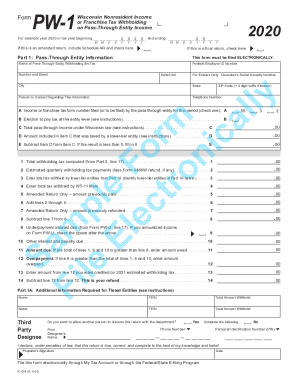

The WI PW-1 form is essential for reporting nonresident income or franchise tax withholding on pass-through entity income in Wisconsin. This guide will provide you with clear, step-by-step instructions to help you complete the form online successfully.

Follow the steps to fill out the WI PW-1 online.

- Click the ‘Get Form’ button to access the WI PW-1 form and open it in your selected online editor.

- Begin filling out Part 1, which includes Pass-Through Entity Information. Enter the name of the pass-through entity alongside the Federal Employer ID Number. Provide the street address, suite or unit, city, state, and ZIP code, including the optional 4-digit suffix.

- If applicable, include the decedent's Social Security Number for estate filings. Provide the contact person's name and telephone number for follow-up queries.

- In Part 1, identify the type of income or franchise tax form filed by the pass-through entity for the reporting period. Select the appropriate option from A to B.

- For total pass-through income under Wisconsin law, report the amount on line C. If any amount was taxed by a lower-tier entity, include this in item D. Calculate the difference by subtracting item D from item C, entering the result in item E.

- Next, determine the total withholding tax computed from Part 2, continuing through lines 1 to 14 as applicable, being sure to follow the prompts closely and providing accurate details.

- In Part 1A, provide additional details as required for tiered entities, including names and amounts withheld. Mark whether a third party designee is allowed to discuss this return.

- Complete Part 2 by listing all nonresident shareholders, partners, or members, including their names, addresses, and relevant tax identification numbers.

- Sum the total withholding from all pages and ensure all required fields are complete before proceeding.

- Finally, review the entire form for accuracy. Once completed, save your changes, and proceed to download, print, or share the completed form as necessary.

Start filling out your WI PW-1 online today for a smooth and accurate tax process.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.