Loading

Get De Dor 200-01-x-i 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE DoR 200-01-X-I online

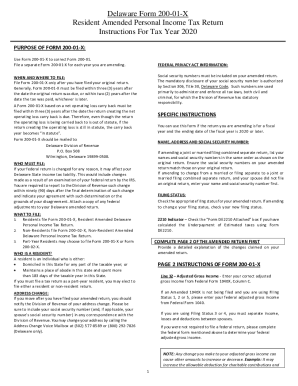

This guide provides comprehensive, step-by-step instructions for completing the Delaware Form 200-01-X-I, the Resident Amended Personal Income Tax Return. Whether you are experienced with tax forms or a first-time filer, this resource will help you navigate the process with ease.

Follow the steps to successfully complete your amended tax return.

- Press the ‘Get Form’ button to access the DE DoR 200-01-X-I online. This will open the form in the editor for you to begin your amendments.

- Begin by entering your name, address, and social security number at the top of the form. Ensure that this information matches that from your original return to avoid processing delays.

- Select the appropriate filing status on the form. If you are changing your filing status from your original return, indicate your new status accordingly.

- Complete page 2 of the amended return first. Provide a detailed explanation of the changes claimed, referencing the specific lines of the original return that are being amended.

- Adjust your adjusted gross income (AGI) at Line 32, entering the correct amount based on your amended federal return. This is crucial as errors could impact other deductions and credits.

- If applicable, check the box for the DE2210 Attached if you have calculated underpayment of estimated taxes that need to be included with your amended form.

- Attach any corrected W-2 forms and necessary documentation to ensure your changes are well supported.

- Review your entries for accuracy. Confirm that no mistakes were made in your social security number, AGI, and explanation of changes.

- Save your changes regularly as you fill out the form. Once completed, you have the option to download, print, or share your amended return for submission.

Complete your Delaware Form 200-01-X-I online today to ensure accurate processing of your amended tax return!

Related links form

On the flip side, corporations must file a federal tax return regardless of whether they have taxable income. This means that if you form a corporation, even if you spent no money and received no income, you must still file a corporate federal tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.