Loading

Get Ut Tc-69 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-69 online

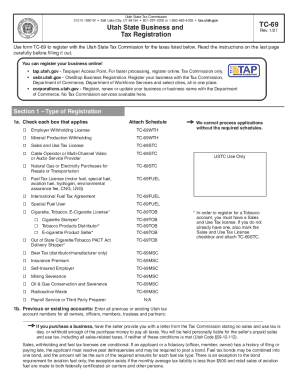

Filling out the UT TC-69 form is an essential step for individuals and businesses registering with the Utah State Tax Commission. This guide provides you with a clear, step-by-step approach to completing the form online, ensuring that you can navigate the process with confidence.

Follow the steps to accurately complete the UT TC-69 online form.

- Press the ‘Get Form’ button to access the UT TC-69 form. This will enable you to fill it out electronically in an online editor.

- In Section 1, select the type of registration that applies to your business. Review the list carefully and check each relevant box to indicate the necessary tax licenses.

- Proceed to Section 2. You must provide general information about your business. Indicate your organizational structure by checking the appropriate box.

- Fill out the organization date and provide your Department of Commerce entity number, federal identification number, and contact information in the designated fields.

- In Section 2g, input your business or trade name along with the physical address. Ensure that the address accurately reflects your business location.

- Continue to Section 2h, where you are required to list all officers, general partners, managing members, or trustees associated with the business. Make sure to include their social security numbers and home addresses.

- Describe the nature of your business in Section 2i, providing detailed information about the types of products or services offered.

- In Section 3, read the signature requirements carefully. Ensure that the proper individual signs the form according to your organizational structure.

- After completing all sections, review your form for any errors or missing information. Once everything is accurate, you can save your changes, download, print, or share the completed form.

Complete your UT TC-69 form online today to streamline your registration process!

A Tax Identification Number (TIN) is a nine-digit number used as a tracking number by the U.S. Internal Revenue Service (IRS) and is required information on all tax returns filed with the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.