Loading

Get Nv Txr-030.01 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV TXR-030.01 online

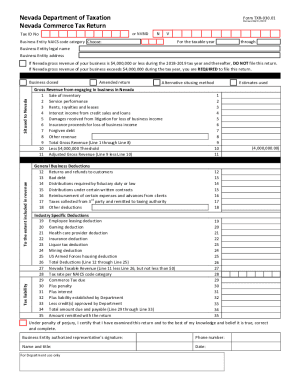

Filling out the NV TXR-030.01, also known as the Nevada commerce tax return, is essential for businesses with gross revenue exceeding $4,000,000 in Nevada. This guide offers clear, step-by-step instructions to help users navigate the online form smoothly.

Follow the steps to complete the Nevada commerce tax return effectively.

- Click ‘Get Form’ button to access the NV TXR-030.01 and open it for online completion.

- Enter the tax ID number or NVBID in the designated field.

- Select the appropriate business entity NAICS code category from the provided options.

- Indicate the taxable year by entering the starting and ending dates in the specified fields.

- Provide the legal name of your business entity as it appears in official documents.

- Fill in your business entity address accurately, ensuring all information is current.

- Review the revenue requirements and if your gross revenue is $4,000,000 or less, note that filing this return is not necessary.

- If applicable, report your total gross revenue from the various categories (sales of inventory, services, rents, etc.) on the form.

- Calculate the adjusted gross revenue by subtracting the $4,000,000 threshold from your total gross revenue, ensuring all entries are correctly aligned.

- Complete the general business deductions section, listing any applicable deductions like returns or refunds.

- Continue with the industry-specific deductions section, if applicable, by reporting relevant deductions.

- Calculate total deductions from the provided lines to find the Nevada taxable revenue, ensuring accuracy in your calculations.

- Determine the tax rate based on your NAICS code category and calculate the commerce tax due.

- Account for any penalties, interest, or credits as listed on the form to find the total amount due and payable.

- Sign the form electronically, certifying its accuracy, and enter the required information of the authorized representative.

- Finally, save changes to your form, and choose to download, print, or share the completed document as needed.

Complete your NV TXR-030.01 online to ensure compliance with Nevada taxation requirements.

Related links form

The commerce tax applies to businesses with more than $4 million in annual gross revenue. But a business is required to file a commerce tax return even if it has no tax liability. The commerce tax rate varies by industry and ranges from .051% to .331%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.