Loading

Get Pa Dor Rev-181 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DoR REV-181 online

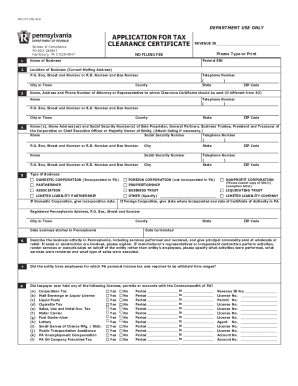

Filling out the PA DoR REV-181 form online is a straightforward process that can help you obtain a tax clearance certificate in Pennsylvania. This guide provides clear, step-by-step instructions to assist you in completing each section of the form with ease, regardless of your prior experience.

Follow the steps to successfully complete your online application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the business in the designated field (section 1). Ensure the name matches official documentation to avoid delays.

- Provide the current mailing address of the business in section 2. Include accurate details to ensure correspondence is sent to the right location.

- Fill in the revenue ID and federal employer identification number (EIN). This is crucial for identification with tax authorities.

- In section 4, provide the name, address, and phone number of the attorney or representative if different from the business address. If this is not applicable, you may leave it blank.

- List the names, addresses, and social security numbers of individuals associated with the business in section 5. Include sole proprietors, general partners, or officers as required.

- Select the type of business from the options provided in section 6. Be specific regarding your business structure.

- Complete section 7 to indicate whether the business had employees for whom Pennsylvania personal income tax was withheld.

- In section 8, respond to questions about any licenses or permits held by the business. Provide additional details for any affirmative responses.

- If the business has previously held assets, complete section 9 with the name, address, and acquisition date of any predecessor business.

- Fill out any real estate ownership information in sections 10 and 11, if applicable. This includes details about current holdings and previous transfers.

- As you proceed through the sections, ensure you address all questions, particularly those about past business activities (section 15) and pending matters with the tax department (section 14).

- In section 26, complete the certification by providing the name and signature of the authorized officer, ensuring it aligns with names listed previously.

- Finally, review all entered information for accuracy. Once confirmed, you can save changes, download, print, or share the form as needed.

Start filling out your PA DoR REV-181 online today to ensure a smooth and efficient application process.

Related links form

To dissolve your domestic LLC in Pennsylvania, you must provide the completed Certificate of Dissolution, Domestic Limited Liability Company (DCSB: 15-8975/8978) form to the Department of State by mail, in person, or online.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.