Loading

Get Mi L-1040 Instructions - Lansing City 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI L-1040 Instructions - Lansing City online

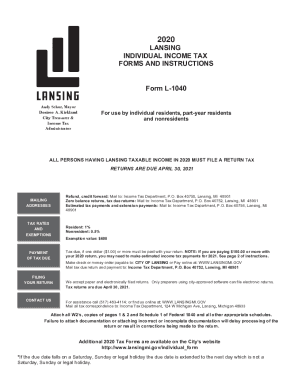

This guide provides clear and supportive instructions on filling out the MI L-1040 form online. Whether you are a resident, part-year resident, or nonresident, this guide will help you navigate through each section of the form effectively.

Follow the steps to successfully complete the MI L-1040 form online.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Enter your personal information, including your name, current address, and Social Security number. If filing jointly, include your partner's details as well.

- Indicate your residency status by marking the appropriate box; choose between 'Resident,' 'Nonresident,' or 'Part-Year Resident.'

- Select your filing status, marking the relevant box, especially if you are married filing separately.

- Report your income, ensuring to include the right figures from your federal return. Items to list include wages, interest, dividends, and any other applicable income.

- Calculate and confirm your exemptions. Use the Exemptions schedule on page 2 of the form to report and claim your total exemption amount.

- Complete the Deductions schedule to report any applicable deductions and determine your taxable income.

- If you have taxes withheld, enter this amount and check for any applicable credits for taxes paid to another city.

- Finalize your return by signing and dating the form. Ensure all required documentation and W-2 forms are attached before submission.

- Once complete, save your changes, and choose to download, print, or share the form as needed.

Complete your MI L-1040 form online today to ensure timely submission and compliance with Lansing tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Overview of Michigan Taxes Michigan is a flat-tax state that levies a state income tax of 4.25%. Twenty-two Michigan cities charge their own local income taxes on top of the state income tax. Local income tax rates top out at 2.4%. Most people claim 0-5 allowances, check W-4 rules for details.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.