Get Ny Dtf St-140 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF ST-140 online

How to fill out and sign NY DTF ST-140 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Choosing a authorized specialist, making a scheduled appointment and coming to the business office for a personal meeting makes finishing a NY DTF ST-140 from beginning to end exhausting. US Legal Forms lets you rapidly generate legally valid documents based on pre-built online blanks.

Execute your docs in minutes using our easy step-by-step instructions:

- Get the NY DTF ST-140 you need.

- Open it with cloud-based editor and start adjusting.

- Complete the blank fields; concerned parties names, places of residence and phone numbers etc.

- Customize the blanks with exclusive fillable areas.

- Add the particular date and place your e-signature.

- Click on Done after twice-examining all the data.

- Save the ready-created document to your device or print it out as a hard copy.

Easily create a NY DTF ST-140 without having to involve professionals. There are already over 3 million customers taking advantage of our unique library of legal documents. Join us today and gain access to the #1 collection of browser-based samples. Test it yourself!

How to edit NY DTF ST-140: customize forms online

Enjoy the user friendliness of the multi-featured online editor while filling out your NY DTF ST-140. Make use of the range of tools to rapidly complete the blanks and provide the requested data in no time.

Preparing documentation is time-taking and expensive unless you have ready-made fillable templates and complete them electronically. The easiest way to cope with the NY DTF ST-140 is to use our professional and multi-featured online editing tools. We provide you with all the necessary tools for quick form fill-out and enable you to make any edits to your templates, adapting them to any requirements. In addition to that, you can make comments on the changes and leave notes for other people involved.

Here’s what you can do with your NY DTF ST-140 in our editor:

- Fill out the blank fields utilizing Text, Cross, Check, Initials, Date, and Sign options.

- Highlight crucial details with a desired color or underline them.

- Conceal sensitive details with the Blackout option or simply remove them.

- Add pictures to visualize your NY DTF ST-140.

- Replace the original text with the one suiting your requirements.

- Leave comments or sticky notes to inform others about the updates.

- Place extra fillable areas and assign them to specific recipients.

- Protect the template with watermarks, add dates, and bates numbers.

- Share the paperwork in various ways and save it on your device or the cloud in different formats once you finish modifying.

Working with NY DTF ST-140 in our robust online editor is the quickest and most productive way to manage, submit, and share your paperwork the way you need it from anywhere. The tool operates from the cloud so that you can utilize it from any location on any internet-connected device. All templates you generate or complete are safely kept in the cloud, so you can always open them whenever needed and be assured of not losing them. Stop wasting time on manual document completion and get rid of papers; make it all on the web with minimum effort.

Related links form

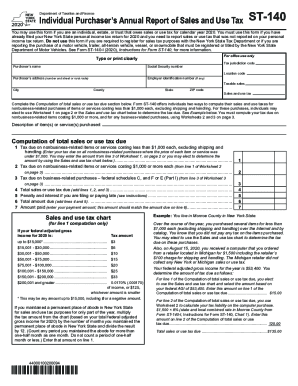

The reporting periods covered by quarterly returns are March 1 through May 31, June 1 through August 31, September 1 through November 30, and December 1 through February 28/29.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.