Loading

Get Ny Dof Cr-q2 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DoF CR-Q2 online

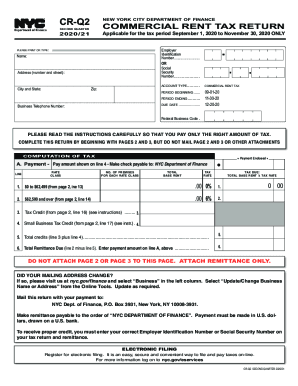

Navigating the NY DoF CR-Q2 online form can feel complex, but this guide aims to simplify the process. By following these step-by-step instructions, you can complete your commercial rent tax return efficiently and accurately.

Follow the steps to fill out the NY DoF CR-Q2 online

- Click ‘Get Form’ button to access the online form and open it in your browser.

- Begin by entering your name at the top of the form. Ensure that all fields are completed clearly, as this information is essential for accurate processing.

- In the next section, provide your address, including street number and name, city, state, and zip code. Double-check for any typos to ensure postal accuracy.

- Input your business telephone number for contact purposes, as well as your Employer Identification Number or Social Security Number as required.

- Identify the account type by marking the appropriate option, whether you are filing for a commercial rent tax for the specified period, which is from September 1, 2020, to November 30, 2020.

- Proceed to the computation of tax section. You will need to calculate the total base rent for your premises and find the total remittance due by adhering to the guidelines outlined in the form. Input the amounts into the specified lines carefully.

- Complete the information for each premises you rent by filling out the details requested in the second and third pages of the form. Make sure to provide accurate addresses, rents paid, and any applicable deductions.

- If necessary, refer to the tax credit worksheet to determine if you qualify for any credits, ensuring to follow the instructions that specify required income limits.

- Finalize your return by reviewing all inputted information for accuracy. Once confirmed, you can save your changes, download the completed form, and prepare to print it or share it as needed.

Complete your forms online today to ensure timely and accurate submissions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.