Loading

Get Sc Dor Sc1120 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1120 online

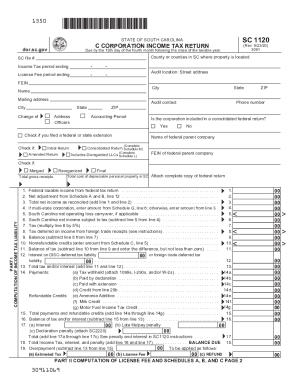

The SC DoR SC1120 form is used for filing the state income tax return for corporations in South Carolina. This guide will assist users in navigating the online completion of the form, ensuring all necessary information is accurately provided.

Follow the steps to complete the SC DoR SC1120 online effectively.

- Click ‘Get Form’ button to obtain the SC DoR SC1120 form and access it in the online editor.

- Begin by filling out the corporation's name, mailing address, and FEIN (Federal Employer Identification Number) in the designated areas.

- Indicate the income tax period ending date and any license fee period ending date as required.

- Complete the audit location details including street address, city, and phone number of the audit contact person.

- Specify if the corporation is part of a consolidated federal return and provide details of the federal parent company if applicable.

- Proceed to Part I, where you will compute the income tax liability. Fill in the total cost of depreciable personal property and gross receipts along with federal taxable income.

- Calculate the South Carolina net income subject to tax by entering necessary adjustments and tax calculations in the appropriate fields.

- In Part II, proceed with the computation of the license fee by filling in the total capital and paid-in surplus figures.

- Complete Schedules A, B, and C as applicable. Include any necessary additions or deductions from federal taxable income.

- Review all entries for accuracy and completeness before saving your progress.

- Once you have finalized the form, options for saving changes, downloading, printing, or sharing the form will be available. Choose your preferred method to complete the process.

Start filling out your SC DoR SC1120 online today to ensure timely submission!

Related links form

To qualify as an S corporation in South Carolina, an IRS Form 2553 must be filed with the Internal Revenue Service. In very few states, you will also be required to file a separate state election, as specified by that state, in order to qualify as a Sub S Corporation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.