Loading

Get Irs 8889 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8889 online

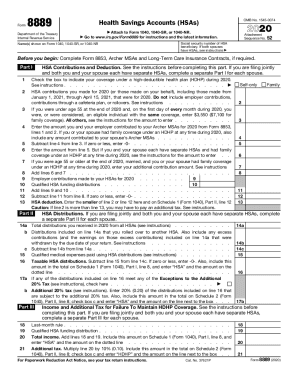

This guide provides clear instructions for filling out Form 8889, which is used for Health Savings Accounts (HSAs). By following the steps outlined here, you will be able to complete the form efficiently and accurately.

Follow the steps to complete Form 8889 effectively.

- Click ‘Get Form’ button to access the document and open it in your preferred editing tool.

- Begin by listing the social security number of the HSA beneficiary in the designated field. If both you and your partner have HSAs, refer to the instructions for guidance.

- Enter your name(s) as shown on your Form 1040, 1040-SR, or 1040-NR. This identification is essential to connect your form with your tax return.

- Complete Part I concerning HSA contributions. Check the appropriate box indicating whether you had self-only or family coverage under a high-deductible health plan during the tax year.

- In subsequent fields, enter the total HSA contributions made for the tax year, ensuring you do not include employer contributions or certain other exceptions as stated in the instructions.

- Follow the calculations outlined in the form, including making relevant adjustments for amounts contributed to Archer MSAs if applicable, ensuring all mathematical operations are accurate.

- Proceed to Part II to report HSA distributions. Here, you will include the total distributions received and calculate any taxable amounts as outlined in various lines and instructions.

- Finally, review all provided information for accuracy, ensuring that each field has been completed according to the guidelines. You can then save your changes, download the form, print, or share it as necessary.

Complete your IRS 8889 form online today to ensure a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form 8889 is the IRS form that helps you to do the following: Report contributions to a Health Savings Account (HSA). Calculate your tax deduction from making HSA contributions. Report distributions you took from the HSA (hopefully for eligible medical expenses).

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.