Loading

Get Irs 9465 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 9465 online

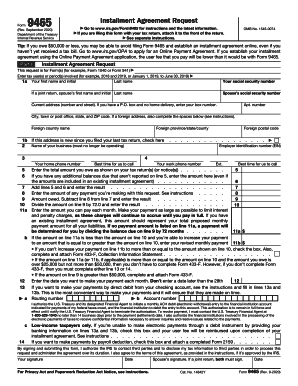

Filling out the IRS 9465 form online can be a straightforward process if you follow the necessary steps carefully. This form, known as the Installment Agreement Request, allows users to request a payment plan for their tax liabilities.

Follow the steps to successfully complete the IRS 9465 online.

- Click the ‘Get Form’ button to access the IRS 9465 form and open it in your preferred editing tool.

- Begin by filling out Part I of your Installment Agreement Request. Enter the specific tax forms and years related to your request in the designated fields.

- Provide your personal information. Fill in your last name, first name and initial, social security number, and spouse’s information if applicable.

- Input your current address. If you have a P.O. Box, ensure to specify that information clearly. Check the box if this is a new address since your last tax return.

- Complete the section regarding your business, if necessary, including your employer identification number, home and work phone numbers, and the best times for the IRS to contact you.

- Declare the total amount owed as indicated on your tax returns or notices, and include any additional balances due as applicable.

- Calculate your total balance due by adding the amounts from the previous fields, and determine any payment you are making with this request.

- Enter the amount you propose to pay each month, and indicate the date you wish to make these payments, ensuring it does not exceed the 28th of the month.

- If opting for direct debit payments, fill in your banking information as per instructions provided in the form.

- Review all entries for accuracy, then sign and date the form. If filing jointly, your spouse must also sign.

- Once completed, save your changes, and then download, print, or share the form as required.

Begin completing your IRS 9465 form online now.

Related links form

Setting up a Payment Plan Now fill out Form 9465, the Installment Agreement Request. You can use the Online Payment Agreement Application on the IRS website if your tax debt is $50,000 or less including interest and penalties. ... You must make your payment by the same day each month.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.