Loading

Get Sc Dor Sc2848 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC2848 online

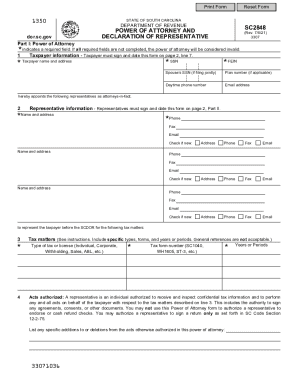

Filling out the SC2848 form is essential for granting power of attorney to a representative before the South Carolina Department of Revenue. This guide provides step-by-step instructions to help users complete the form accurately and effectively.

Follow the steps to complete the SC2848 form online.

- Click ‘Get Form’ button to access the SC2848 and open it in your preferred editor.

- In Part I, enter the taxpayer information, including the taxpayer's name, Social Security Number (SSN), and address. If filing for a business, include the Federal Employer Identification Number (FEIN). If married and filing jointly, input your spouse's information as well.

- Fill in the representative information by listing the names and contact details of the individuals appointed as representatives. Ensure that each representative signs and dates the form in Part II.

- Specify the tax matters you are authorizing your representatives to handle. This includes indicating the type of tax, associated tax form number, and the applicable years or periods. Avoid general terms and be specific.

- In the acts authorized section, describe any specific actions you want your representatives to perform or any limitations you wish to set (e.g., not allowing endorsement of refund checks).

- If you wish to allow your representative to receive refund checks without endorsing them, initial this section and provide the representative's name.

- Decide whether you want to revoke any prior power of attorney. If you do, check the box and attach a copy of the prior document.

- Sign and date the form in the taxpayer signature section. Remember, if this is a joint return, both taxpayers must sign, or provide authorization for one to sign on behalf of the other.

- Representatives must also sign the declaration in Part II, confirming their authority to represent the taxpayer. They must provide their designation and jurisdiction.

- Once all sections are complete, save your changes, then download, print, or share the completed SC2848 form as necessary.

Complete your documents online with confidence and ensure accurate submission.

Anyone over 65 who earned more than $15,000 (single) or $30,000 (married, filing jointly) is required to file a South Carolina state tax return. South Carolina taxes its residents on all income earned even if that income was earned outside of South Carolina. Use Form-1040 to file your South Carolina tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.