Get Irs 3949-a 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 3949-A online

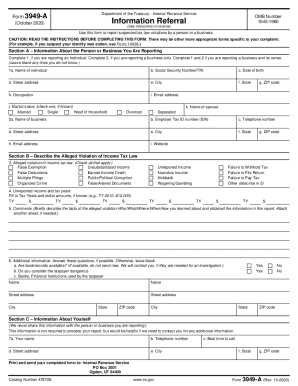

Filling out the IRS 3949-A form is an important process for reporting suspected tax law violations. This guide provides a comprehensive overview of each section of the form, ensuring you have clear and practical steps to complete it accurately online.

Follow the steps to effectively complete the IRS 3949-A form.

- Click ‘Get Form’ button to access the IRS 3949-A document and open it for editing.

- In Section A, you will provide information about the individual or business being reported. If reporting an individual, fill in their name, social security number or taxpayer identification number, date of birth, street address, city, state, ZIP code, occupation, email address, marital status, and spouse’s name if applicable. If reporting a business, enter the business name, employer tax ID number, as well as contact information such as telephone number, street address, city, state, and ZIP code.

- In Section B, describe the alleged violation of income tax law. Check all applicable boxes for the types of violations you are reporting. If there is unreported income, indicate the tax years and the amounts associated with those years.

- Provide comments to briefly describe the circumstances surrounding the alleged violation. Answer all questions in this section to the best of your ability.

- In Section C, enter your information. While it's not mandatory, it can be useful for IRS follow-up. Fill in your name, telephone number, street address, and the best time to contact you.

- Once all sections are completed, review your entries for accuracy and completeness. Save your changes, and then proceed to download or print the completed form.

Complete your IRS 3949-A filing online today to ensure your report is processed efficiently.

Unreported income is huge deal to the IRS. The agency recently estimated that the U.S. loses hundreds of billions per year in taxes due to unreported income. ... When it suspects a taxpayer is failing to report a significant amount of income, it typically conducts a face-to-face examination, also called a field audit.

Fill IRS 3949-A

Form 3949 A (Rev. 2-2007). Page 2. Instructions. Use Form D-3949A to report alleged tax law violations. Complete if you are reporting an individual. Form 3949-A is used to report potential tax violations but does not have to be included when reporting a tax violation. IRS Form 3949A, Section A contains information about the person or business you are reporting for suspected activity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.