Loading

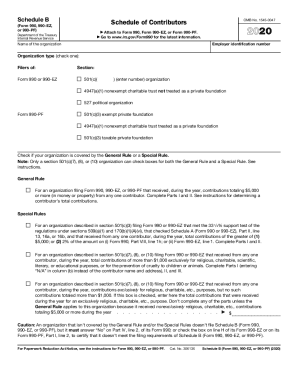

Get Irs 990 - Schedule B 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule B online

Filling out the IRS 990 - Schedule B is an essential task for certain tax-exempt organizations. This guide provides a comprehensive overview and step-by-step instructions on how to complete this form accurately and efficiently online.

Follow the steps to complete the IRS 990 - Schedule B

- Press the ‘Get Form’ button to access the IRS 990 - Schedule B and open it in your chosen editor.

- Begin by entering the employer identification number and the name of the organization at the top of the form.

- Select the type of organization by checking the appropriate box. You may be a 501(c) organization, nonexempt charitable trust, or political organization, among others. Ensure you choose only one type.

- Identify if your organization is covered by the General Rule or a Special Rule by checking the appropriate box. Review the instructions carefully to confirm eligibility based on your contributions received during the year.

- In Part I, list each contributor in column (a) and provide their name, address, and ZIP + 4 in column (b), followed by recording total contributions in column (c). Mark the type of contribution in column (d) as either person, payroll, or noncash, and complete Part II for noncash donations.

- If you have more contributors than space allows, use duplicate copies of Part I to list additional contributors, ensuring to number each entry consecutively from the previous section.

- For noncash contributions, complete Part II where you describe the noncash property given in column (b), providing the fair market value (FMV) in column (c) and the date received in column (d).

- If your organization is a section 501(c)(7), (8), or (10) and has exclusively religious, charitable, etc., contributions that exceed $1,000, complete Part III by documenting the purpose, use of the gift, and details about its transfer.

- After filling in the information, review the entire form for accuracy and completeness. Make any necessary edits before proceeding to save your work.

- Finally, save your changes, and choose the option to download, print, or share the form as needed for your records or filing obligations.

Start completing your IRS 990 - Schedule B online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Publicly available data on electronically filed Forms 990 is available in a machine-readable format through Amazon Web Services (AWS). The data includes Form 990, Form 990-EZ and Form 990-PF and related schedules, with the exception of certain donor information, from 2012 to the present.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.