Loading

Get Irs 5471 - Schedule J 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5471 - Schedule J online

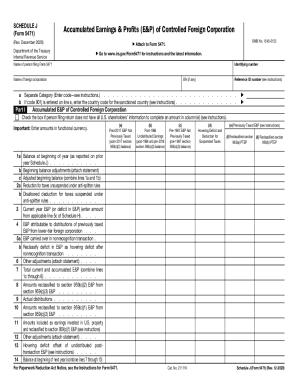

Filling out the IRS 5471 - Schedule J is an essential step for users reporting accumulated earnings and profits of a controlled foreign corporation. This guide will walk you through the process in a clear and supportive manner, enabling you to complete the form accurately online.

Follow the steps to successfully complete the IRS 5471 - Schedule J online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your identifying number, along with your name and the name of the foreign corporation in the corresponding fields.

- Fill in the separate category code on line a, if applicable. If you enter code 901j, provide the country code for the sanctioned country.

- In Part I, report accumulated earnings and profits (E&P) of the controlled foreign corporation. Begin with line 1a, entering the balance at the start of the year as reported on the prior year's Schedule J.

- Enter any beginning balance adjustments on line 1b and calculate the adjusted beginning balance on line 1c by combining lines 1a and 1b.

- Proceed to line 2a and report any reductions due to taxes unsuspended under anti-splitter rules.

- Continue to line 3, inputting the current year E&P or deficit, taking the amount from the applicable line of Schedule H.

- Include E&P attributed to distributions from lower-tier foreign corporations in line 4.

- Complete additional lines for any carryovers, adjustments, and reclassifications as directed in the form instructions, ensuring to attach any required statements.

- Finally, calculate the total current and accumulated E&P on line 7 and check all information for accuracy before proceeding.

- Save changes, download, print, or share the completed Schedule J as needed.

Start completing your IRS 5471 - Schedule J online today for a smooth and efficient filing experience.

Whereas Form 5472 is for US companies that are owned by foreign persons, Form 5471 is for foreign companies owned by US persons. ... This means that if you own a Hong Kong corporation, a Panama corporation, a BVI corporation, or any other non-US corporation, it is reportable under Form 5471.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.