Get Fl Dr-908 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-908 online

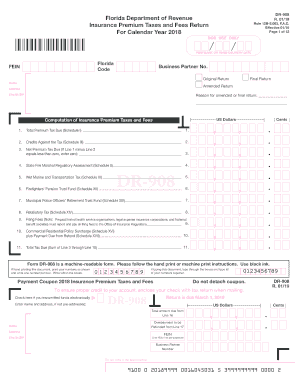

Filling out the FL DR-908 form, also known as the Insurance Premium Taxes and Fees Return, can seem challenging, especially for users with little legal experience. This guide aims to provide a clear, step-by-step process to facilitate your completion of the form accurately and efficiently.

Follow the steps to complete the FL DR-908 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the business information at the top of the form, including the Florida Code, FEIN (Federal Employer Identification Number), and Business Partner Number. Indicate whether this is the original return, a final return, or an amended return. Provide the name and address of the business, including the city, state, and ZIP code.

- If this is an amended or final return, specify the reason for this change in the designated area.

- Proceed to the computation section for Insurance Premium Taxes and Fees. Here, you will fill out lines for Total Premium Tax Due and Credits Against the Tax according to the schedules appropriate for your business type.

- Calculate the Net Premium Tax Due by subtracting the Credits Against the Tax from the Total Premium Tax Due. If the result is less than zero, enter zero.

- Complete the remaining fields for applicable taxes, such as State Fire Marshal Regulatory Assessment, various fund contributions, and any applicable fees.

- Ensure all calculations are accurate and that all required schedules are included. This may entail further sections for annuity premiums, credits against the premium tax, or any additional required information relating to Workers' Compensation or Municipal Police Officers’ Retirement Trust Fund.

- In the declaration section, affirm that the return is true and complete by signing as the officer. Include the title, date, and contact information.

- Check for necessary attachments, such as the Florida Business Page of your Annual Statement, and confirm that your payment method is indicated if you are submitting a payment.

- Finally, review the form for accuracy and completeness. Save your changes, then download, print, or share the completed form as needed.

Complete the FL DR-908 online today to ensure timely submission and compliance with state tax regulations.

Get form

You can obtain a Florida prepaid recipient card by enrolling in the Florida Prepaid program through their official website. After you complete the enrollment, the card will be mailed to the address you provided. If you need assistance during the application process, US Legal Forms can offer the necessary forms and guidance to ensure you receive your card promptly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.