Get Fl Dr-430 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-430 online

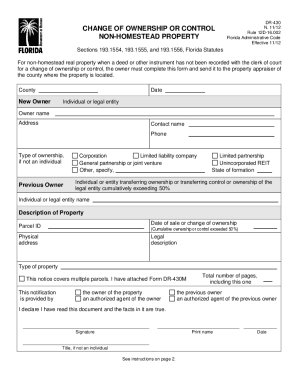

This guide provides a clear and supportive overview of how to complete the FL DR-430 form, which is necessary for reporting changes in ownership or control of non-homestead property in Florida. Follow these instructions to ensure a smooth and accurate submission.

Follow the steps to complete the FL DR-430 form successfully.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the county where the property is located at the top of the form.

- Provide details about the new owner. This includes the owner’s name, whether they are an individual or legal entity, their address, contact name, and phone number.

- Indicate the type of ownership if the new owner is not an individual. This could include options such as corporation, limited liability company, or any other type of ownership structure.

- Fill in the previous owner's details, including their name and type of entity. You should clarify the state of formation if applicable.

- Describe the property being reported. Include the date of sale or change of ownership, the parcel ID, physical address, and legal description.

- If this notice pertains to multiple parcels, check the appropriate box and ensure you have attached Form DR-430M.

- Specify the individual or entity sending the notification, whether it is the new owner or an authorized agent.

- Indicate the total number of pages being submitted, including the current page.

- Sign the document, print your name, and provide your title if you are not an individual.

- Enter the date of signing. Review all entered information for accuracy before finalizing.

- Save your changes, download, print, or share the completed form as necessary to ensure proper submission to the property appraiser.

Complete the FL DR-430 online today for efficient submission and compliance.

Calculating the homestead exemption in Florida involves determining the assessed value of your property and applying the exemption amount, which could be up to $50,000. Your exemption amount reduces the taxable value of your home, resulting in lower property taxes. Using FL DR-430 simplifies this process, as it includes necessary details to ensure accurate calculations. For further assistance, consider using uslegalforms for straightforward guidance on calculating your exemption.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.