Loading

Get Fl Dr-15dss 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-15DSS online

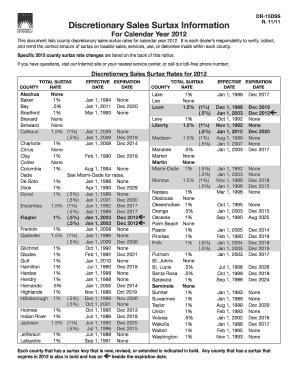

The FL DR-15DSS is a crucial document for businesses in Florida to accurately report discretionary sales surtax rates. This guide provides clear instructions for completing the form online, ensuring that users can easily navigate each section and field.

Follow the steps to fill out the FL DR-15DSS online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Review the header section of the form. Ensure you understand the purpose of the document, which is to report and remit the correct surtax based on county rates.

- Locate the table that lists the county surtax rates. Familiarize yourself with the rates applicable to your business location, noting any expiration dates.

- In the designated field, input the total sales amount subject to surtax. Ensure accuracy, as this will affect your tax liability.

- Reference the surtax rate for your county from the previously reviewed table. Apply this rate to the total sales amount to calculate the amount of surtax owed.

- Fill in any additional required information as instructed, such as your business name, tax identification number, and contact information.

- Review the completed form for accuracy, ensuring that all fields are filled out correctly and that calculations are precise.

- Once satisfied with the information entered, proceed to save changes, download, print, or share the form as needed.

Complete your forms online efficiently and accurately today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The collection allowance rate in Florida is set by state regulations and allows business owners to retain a small percentage of the sales tax collected. This rate is designed to help businesses manage their tax collection responsibilities. As you complete the FL DR-15DSS, be sure to apply the current collection allowance rate to optimize your tax filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.