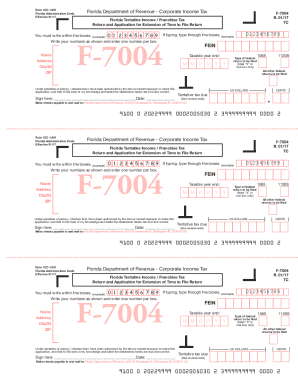

Get Fl Dor F-7004 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DoR F-7004 online

How to fill out and sign FL DoR F-7004 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Submitting your income and completing all essential tax documents, including FL DoR F-7004, is the sole responsibility of a US citizen. US Legal Forms makes your tax management more accessible and accurate.

You can locate any legal forms you need and complete them electronically.

Store your FL DoR F-7004 securely. Ensure that all your relevant documents and information are appropriately organized while keeping in mind the deadlines and tax regulations established by the IRS. Simplify the process with US Legal Forms!

- Retrieve FL DoR F-7004 in your browser from any device.

- Access the fillable PDF file with a single click.

- Begin filling out the form field by field, following the instructions of the advanced PDF editor’s interface.

- Carefully enter details and figures.

- Click the Date box to automatically insert today’s date or change it manually.

- Utilize Signature Wizard to create your personalized e-signature and validate it within minutes.

- Refer to the IRS guidelines if you have any remaining questions.

- Press Done to save the changes.

- Proceed to print the document, download it, or share it via Email, text message, Fax, or USPS without leaving your web browser.

How to modify Get FL DoR F-7004 2017: personalize forms online

Experience a hassle-free and paperless method of altering Get FL DoR F-7004 2017. Utilize our dependable online service and save a significant amount of time.

Creating each form, including Get FL DoR F-7004 2017, from the ground up consumes a lot of time, so having a proven platform of pre-designed form templates can work wonders for your efficiency.

However, altering them can be challenging, particularly with PDF files. Thankfully, our vast collection includes an integrated editor that allows you to swiftly complete and modify Get FL DoR F-7004 2017 without leaving our site, so you won’t waste time processing your forms. Here’s what you can accomplish with your document using our service:

Whether you need to process editable Get FL DoR F-7004 2017 or any other template in our catalog, you are on the right path with our online document editor. It’s straightforward and secure and doesn’t require any specialized knowledge.

Our web-based solution is designed to address almost everything you can think of regarding document modification and completion. No more utilizing traditional methods for managing your documents. Choose a more effective option to help you optimize your workflows and reduce paper dependency.

- Step 1: Locate the necessary form on our webpage.

- Step 2: Click Get Form to access it in the editor.

- Step 3: Utilize professional editing tools that allow you to insert, delete, annotate, and emphasize or obscure text.

- Step 4: Generate and attach a legally-binding signature to your document using the sign option from the top menu.

- Step 5: If the template's layout isn’t as desired, employ the tools on the right to remove, add, and rearrange pages.

- Step 6: Incorporate fillable fields so others can be invited to complete the template (if relevant).

- Step 7: Distribute or submit the form, print it, or select the format in which you want to download the document.

To mail your F-7004 in Florida, you should send it to the specific address provided by the Florida Department of Revenue, which usually varies based on your business type and situation. Checking the official FL DoR website will provide you with updated and accurate mailing details. Properly addressing your submission ensures a smoother process and timely processing of your extension request.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.