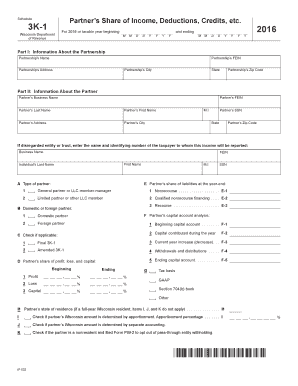

Get Wi Dor Schedule 3k-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign WI DoR Schedule 3K-1 online

How to fill out and sign WI DoR Schedule 3K-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Tax form completion can turn into a considerable barrier and major hassle if accurate help is not provided.

US Legal Forms has been created as an online solution for WI DoR Schedule 3K-1 e-filing and presents numerous advantages for taxpayers.

Utilize US Legal Forms to ensure a secure and straightforward process for filling out the WI DoR Schedule 3K-1.

- Acquire the template on the website in the relevant section or through the search engine.

- Hit the orange button to open it and wait for it to finish loading.

- Examine the template and adhere to the instructions. If you have never filled out the template previously, follow the line-by-line guidance.

- Focus on the highlighted fields. These are fillable and require specific information to be entered. If unsure of what information to provide, consult the guidelines.

- Always sign the WI DoR Schedule 3K-1. Utilize the built-in feature to generate the e-signature.

- Choose the date field to automatically populate the correct date.

- Review the template to make edits before the e-filing.

- Click the Done button in the upper menu once you have completed it.

- Save, download, or export the finished template.

How to modify Get WI DoR Schedule 3K-1 2016: personalize forms online

Have your hassle-free and paperless method of modifying Get WI DoR Schedule 3K-1 2016. Utilize our trustworthy online option and save a considerable amount of time.

Creating each form, including Get WI DoR Schedule 3K-1 2016, from the beginning consumes excessive time, so utilizing a reliable platform of pre-uploaded document templates can greatly enhance your productivity.

However, altering them can be challenging, particularly with documents in PDF format. Fortunately, our comprehensive library includes a built-in editor that allows you to effortlessly complete and modify Get WI DoR Schedule 3K-1 2016 without leaving our site, preventing any time wastage in adjusting your forms. Here’s what to do with your document using our service:

Whether you need to execute modifiable Get WI DoR Schedule 3K-1 2016 or any other document available in our catalog, you’re on the right path with our online document editor. It’s user-friendly and secure and does not require you to possess specialized skills.

Our web-based tool is designed to manage practically everything you can envision regarding file editing and execution. Move away from the traditional method of handling your forms. Opt for a professional solution to assist you in streamlining your tasks and making them less dependent on paper.

- Step 1. Find the required document on our website.

- Step 2. Click on Get Form to launch it in the editor.

- Step 3. Utilize specialized editing tools that enable you to add, remove, annotate, and highlight or blackout text.

- Step 4. Create and append a legally-recognized signature to your document by using the signing option from the upper toolbar.

- Step 5. If the document format doesn’t appear as needed, use the options on the right to delete, add, and rearrange pages.

- Step 6. Add fillable fields so that other parties can be invited to complete the document (if necessary).

- Step 7. Share or distribute the form, print it, or choose the format in which you’d prefer to download the file.

Get form

You may be exempt from Wisconsin withholding if you meet specific criteria, such as having no tax liability or if you anticipate a refund. To determine your eligibility accurately, consider how your income, including that from the WI DoR Schedule 3K-1, affects your overall state tax obligations. For clear instructions on claiming exemption, uslegalforms can assist you with essential forms and information.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.