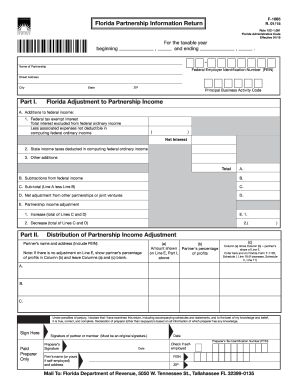

Get FL DoR F-1065 2014

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Apportion online

How to fill out and sign Selfemployed online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Confirming your revenue and declaring all the essential taxation papers, including FL DoR F-1065, is a US citizen?s sole duty. US Legal Forms tends to make your tax control more transparent and efficient. You can find any juridical blanks you want and fill out them electronically.

How to complete FL DoR F-1065 on the web:

-

Get FL DoR F-1065 in your browser from your gadget.

-

Gain access to the fillable PDF document with a click.

-

Start completing the template field by field, using the prompts of the sophisticated PDF editor?s user interface.

-

Correctly input textual material and numbers.

-

Select the Date field to set the actual day automatically or alter it manually.

-

Apply Signature Wizard to design your custom e-signature and certify within minutes.

-

Check IRS instructions if you still have inquiries..

-

Click Done to confirm the revisions..

-

Proceed to print the file out, save, or send it via E-mail, text messaging, Fax, USPS without quitting your web browser.

Keep your FL DoR F-1065 securely. Make sure that all your correct papers and data are in are in right place while keeping in mind the time limits and tax rules set by the Internal Revenue Service. Do it easy with US Legal Forms!

How to modify 1125-A: customize forms online

Check out a standalone service to deal with all of your paperwork easily. Find, modify, and complete your 1125-A in a single interface with the help of smart instruments.

The times when people had to print out forms or even write them by hand are over. These days, all it takes to find and complete any form, like 1125-A, is opening just one browser tab. Here, you can find the 1125-A form and customize it any way you need, from inserting the text directly in the document to drawing it on a digital sticky note and attaching it to the record. Discover instruments that will simplify your paperwork without additional effort.

Click on the Get form button to prepare your 1125-A paperwork rapidly and start editing it instantly. In the editing mode, you can easily fill in the template with your details for submission. Simply click on the field you need to alter and enter the information right away. The editor's interface does not demand any specific skills to use it. When done with the edits, check the information's accuracy once again and sign the document. Click on the signature field and follow the instructions to eSign the form in a moment.

Use More instruments to customize your form:

- Use Cross, Check, or Circle instruments to pinpoint the document's data.

- Add text or fillable text fields with text customization tools.

- Erase, Highlight, or Blackout text blocks in the document using corresponding instruments.

- Add a date, initials, or even an image to the document if necessary.

- Use the Sticky note tool to annotate the form.

- Use the Arrow and Line, or Draw tool to add visual components to your file.

Preparing 1125-A forms will never be puzzling again if you know where to search for the suitable template and prepare it quickly. Do not hesitate to try it yourself.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing subtractions

Watch this useful video if you want to complete the F-7004 faster. The majority of the problems you will likely face in the completion process are already solved in it.

Ptin FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to FL DoR F-1065

- F-1065N

- 12C-1

- preparer

- myflorida

- subtractions

- F-7004

- ptin

- apportioning

- apportion

- irc

- preparers

- selfemployed

- 1125-A

- 2013

- beginningof

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.