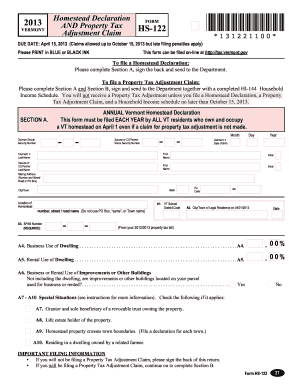

Get Vt Form Hs-122 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign VT Form HS-122 online

How to fill out and sign VT Form HS-122 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax documents can become a significant challenge and a major hassle if adequate help isn't available.

US Legal Forms is created as an online solution for VT Form HS-122 electronic filing and offers various benefits for taxpayers.

Click the Done button on the top menu once you have finished it. Save, download, or export the finalized document.

- Acquire the form on the site in the specific section or through the search engine.

- Click the orange button to access it and wait for it to load.

- Examine the form and pay close attention to the guidelines. If you haven't completed the template before, follow the step-by-step instructions.

- Focus on the highlighted fields. These are editable and require specific information to be filled in. If you're unsure what data to input, refer to the guidelines.

- Always sign the VT Form HS-122. Use the integrated tool to create your electronic signature.

- Choose the date field to automatically insert the current date.

- Review the document before submitting it and make any necessary changes.

How to revise Get VT Form HS-122 2013: personalize forms online

Select a reliable document editing solution you can rely on. Revise, execute, and sign Get VT Form HS-122 2013 securely online.

Editing forms, such as Get VT Form HS-122 2013, can often be difficult, particularly if they were provided in a digital form and you lack access to specialized tools. While there are remedies to circumvent this, you run the risk of submitting a form that fails to meet the necessary submission standards. Moreover, using a printer and scanner is not a feasible option as it is both time-consuming and resource-intensive.

We provide a more straightforward and effective method for completing documents. A vast collection of form templates that are easy to tailor, verify, and render fillable for certain users. Our platform encompasses much more than just a collection of templates. One of the greatest advantages of utilizing our service is the ability to amend Get VT Form HS-122 2013 directly on our site.

Being an online-based service, it frees you from the necessity of downloading any software. Furthermore, not all company policies permit you to install it on your work computer. Here's the most efficient method to securely and easily finalize your forms with our service.

Forget about paper and other inefficient methods of altering your Get VT Form HS-122 2013 or other documents. Opt for our solution that merges one of the most extensive libraries of customizable templates with strong document editing services. It's straightforward and secure, potentially saving you considerable time! Don’t just take our word for it, give it a try yourself!

- Click the Get Form > and you'll be taken straight to our editor.

- Once opened, initiate the editing sequence.

- Select checkmarks, circles, lines, arrows, crosses, and additional options to annotate your form.

- Choose the date field to add a specific date to your document.

- Insert text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option to create fillable {fields.

- Select Sign from the upper toolbar to generate your legally binding signature.

- Click DONE to save, print, share, or download the document.

Get form

You can pick up tax forms at your local tax office or certain government buildings. Some libraries and community centers also stock essential forms, such as the VT Form HS-122. If you prefer digital formats, consider visiting the IRS or state tax agency websites for downloads.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.