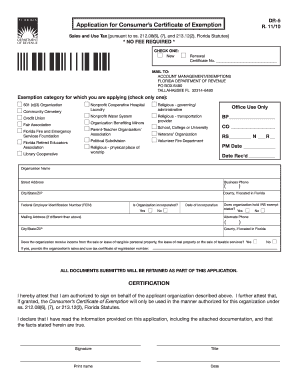

Get Fl Dor Dr-5 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DoR DR-5 online

How to fill out and sign FL DoR DR-5 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your income and submitting all the essential tax documentation, including FL DoR DR-5, is solely the responsibility of a US citizen.

US Legal Forms simplifies your tax management, making it more straightforward and precise.

Store your FL DoR DR-5 securely. Ensure all your accurate documents and records are organized while keeping in mind the deadlines and tax regulations set by the Internal Revenue Service. Make it easy with US Legal Forms!

- Obtain FL DoR DR-5 through your web browser using any device.

- Access the fillable PDF form with a click.

- Begin completing the template field by field, adhering to the prompts of the advanced PDF editor's interface.

- Carefully input text and numbers.

- Click the Date field to automatically insert today's date or manually adjust it.

- Use the Signature Wizard to create your personalized e-signature and authenticate within minutes.

- Consult the Internal Revenue Service guidelines if you have further inquiries.

- Press Done to finalize the changes.

- Proceed to print the document, download, or send it via Email, SMS, Fax, or USPS without leaving your browser.

How to amend Get FL DoR DR-5 2010: personalize forms online

Approve and distribute Get FL DoR DR-5 2010 along with any additional business and personal documents online without squandering time and resources on printing and mailing. Make the most of our online document editor featuring an integrated compliant eSignature tool.

Authorizing and submitting Get FL DoR DR-5 2010 files digitally is faster and more efficient than handling them on paper. However, it necessitates utilizing online solutions that ensure a high level of data security and offer you a certified instrument for producing eSignatures. Our robust online editor is precisely what you require to finalize your Get FL DoR DR-5 2010 and other personal and business or tax documents accurately and appropriately according to all the specifications. It provides all the essential tools to swiftly and easily complete, alter, and sign documents online and insert Signature fields for additional individuals, indicating who and where should sign.

It only takes a few straightforward steps to finalize and sign Get FL DoR DR-5 2010 online:

When signing Get FL DoR DR-5 2010 with our all-inclusive online solution, you can always be confident that it will be legally binding and admissible in court. Prepare and submit documents in the most advantageous manner possible!

- Open the chosen file for further handling.

- Utilize the top panel to add Text, Initials, Image, Check, and Cross marks to your template.

- Highlight the important information and obscure or erase the sensitive ones if necessary.

- Click on the Sign tool above and determine how you want to eSign your document.

- Sketch your signature, type it, upload its image, or choose another method that fits you.

- Navigate to the Edit Fillable Fields panel and place Signature areas for other individuals.

- Click on Add Signer and provide your recipient’s email to assign this field to them.

- Ensure that all information provided is comprehensive and accurate before you click Done.

- Distribute your document with others using one of the available options.

Get form

Related links form

Obtaining a Florida sales tax number is essential for businesses selling taxable goods or services. Begin by registering with the Florida Department of Revenue by completing the application online. You will receive your sales tax number after processing, which allows you to collect sales tax from customers. This step is critical in maintaining compliance with state tax regulations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.