Get Ttb F 5154.2 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TTB F 5154.2 online

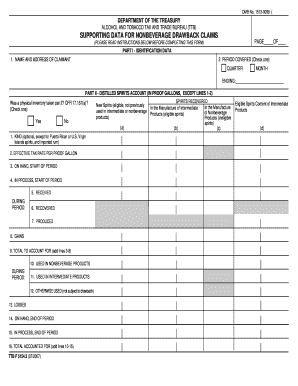

The TTB F 5154.2 form is essential for submitting drawback claims associated with nonbeverage products. This guide provides a detailed, step-by-step approach to completing the form online, ensuring that users of all backgrounds can confidently navigate the process.

Follow the steps to complete your TTB F 5154.2 form accurately.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In Part I, fill in your name and address in the claimant section. Next, select the appropriate box to indicate the period covered by the claim, specifying either a quarter or month ending.

- Proceed to Part II. Indicate whether a physical inventory was taken by checking 'Yes' or 'No.' Complete the sections regarding distilled spirits, noting the kind, effective tax rate, and quantities on hand at the start of the period as well as those received during the period.

- For each eligible spirit, ensure to account for gains and losses, including how they impact the total quantity to be accounted for and those used in nonbeverage products.

- Move to Part III, where you will provide detailed information about the production of nonbeverage products. Include the name of each product, formula number, and the amount of spirits used, making distinctions between eligible and ineligible spirits.

- In Part IV, add any additional explanations needed for discrepancies in your distilled spirits account recorded during the physical inventory. You may also need to document the manufacturer's name and the evidence of tax payment if applicable.

- Finally, review the entire form for accuracy and completeness. Once confirmed, you can save your changes, download the document, print it out, or share it as required.

Start completing your TTB F 5154.2 form online today to ensure your nonbeverage drawback claims are submitted accurately.

Get form

Non-potable alcohol refers to alcohol that is not suitable for human consumption, such as industrial alcohol or alcohol used for fuel. This distinction is important in regulatory contexts, like TTB F 5154.2, as specific rules apply to how these substances can be produced, stored, and transported. Understanding non-potable alcohol helps businesses avoid costly mistakes and comply with legal obligations. If you have questions about compliance, consider resources like uslegalforms for guidance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.