Loading

Get Mb33 2006-2026

We are not affiliated with any brand or entity on this form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MB33 online

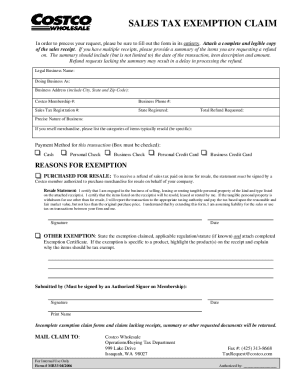

This guide will assist you in completing the MB33 sales tax exemption claim form accurately and efficiently. Follow the instructions to ensure your request is submitted correctly, improving your chances for timely processing and approval.

Follow the steps to successfully complete your MB33 form.

- Press the ‘Get Form’ button to obtain the MB33 form and open it in your document editor.

- Begin by entering your legal business name in the designated field. This should reflect the official name of your business as registered with relevant authorities.

- In the next field, provide the 'Doing Business As' name, if applicable. This is the name under which your business operates, if different from the legal name.

- Fill in your business address, ensuring to include the city, state, and zip code. This information is critical for identifying the location associated with the exemption claim.

- Enter your membership number. This helps in linking the claim to your membership details.

- Provide your business phone number for contact purposes.

- Input your sales tax registration number. This is necessary for verifying your tax exemption status.

- Specify the state where your business is registered. This information is vital for compliance with state tax laws.

- Indicate the total refund amount you are requesting. This should reflect the total sales tax paid on eligible purchases.

- Describe the precise nature of your business. This helps to establish the connection between your purchases and your business activities.

- If you resell merchandise, list the categories of items typically resold. Be specific to help validate your exemption claim.

- Check the appropriate payment method used for the transaction. This includes options such as cash, personal or business checks, or credit cards.

- For the reasons for exemption, if your claim is for resale, ensure to sign and date the resale statement. This certifies your authorization and acknowledgment of liability.

- If claiming an exemption for other reasons, specify the exemption claimed, include applicable regulation/statute if known, and attach any required documentation.

- Ensure that the form is signed and dated by an authorized signer on the membership to validate the claim.

- Once all sections are completed, attach copies of the sales receipts and any required summary documents. Review all entries for accuracy.

- Mail the completed claim form and attached documentation to the address provided on the form. Alternatively, you may fax your claim to the designated number or submit to the specified email address.

Complete your sales tax exemption claims online to streamline the process.

Filling out a tax form involves carefully reading all instructions provided with the form, and accurately entering your personal and financial information. Keep your financial records handy, as they will help you fill in the required sections. Should you require guidance, uslegalforms provides a range of resources to assist you in completing your forms correctly and efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.