Loading

Get Treasury Ttb F 5100.24 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Treasury TTB F 5100.24 online

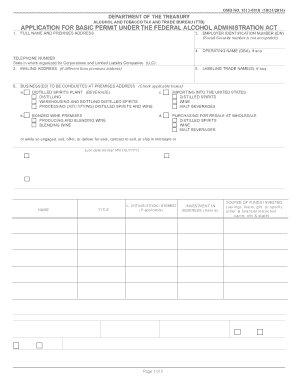

Filling out the Treasury TTB F 5100.24 form is a crucial step for individuals and businesses seeking a permit under the Federal Alcohol Administration Act. This guide provides clear and detailed instructions to ensure you successfully complete the form online.

Follow the steps to efficiently complete the TTB F 5100.24 form online.

- Click the ‘Get Form’ button to access the TTB F 5100.24 form and open it in your preferred online editor.

- Begin by filling out your full name and premises address in the designated fields. Ensure to provide a complete and accurate address.

- If applicable, provide the operating name (doing business as) of your business in the relevant section. If you do not have an operating name, you may leave this blank.

- Enter your telephone number in the appropriate field. This should be the number where you can be reached for any questions regarding your application.

- Specify the state in which your business is organized, particularly if you are a corporation or a limited liability company.

- Complete the mailing address field if it differs from your premises address. This address may be used for correspondence.

- Input your Employer Identification Number (EIN), which is required to identify your business. Note that the Social Security number is not acceptable.

- List any labeling trade names that may apply to your business, which is pertinent for product identification.

- Indicate the business activities you will conduct at the premises address by checking the applicable boxes. Options include distilled spirits plant operations, bonded wine premises, and more.

- Provide a reason for your application. Specify whether you are starting a new business, changing ownership or control, and include the respective dates.

- List all owners, members, managers, or corporate officers and their respective titles, including any stock ownership percentages.

- Complete the additional sections concerning any previous denials of permits or arrests as required, providing full details if necessary.

- Carefully review your application, ensuring all fields are complete and accurate. Make any necessary corrections before submission.

- Once completed, you can save your changes, download the form for records, print it if necessary, or share it with relevant parties as required.

Begin filling out the Treasury TTB F 5100.24 form online today for your business needs.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You must mail your TTB excise tax return to the address specified on the form you are using or the TTB's official site. Ensure that you include all necessary information to avoid delays or penalties. Being aware of the Treasury TTB F 5100.24 guidelines can help ensure that your submission is accurate and timely.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.