Loading

Get Tx 05-158-a 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 05-158-A online

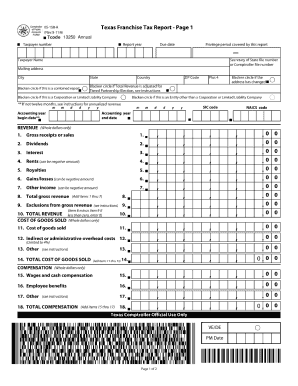

Filling out the TX 05-158-A form online can be a straightforward process with the right guidance. This guide will help you understand each component of the form and provide clear instructions on how to complete it effectively.

Follow the steps to complete the TX 05-158-A form online.

- Click the ‘Get Form’ button to obtain the TX 05-158-A form and open it in the editor.

- Review the general information section at the top of the form. Fill in any required details such as your name and contact information accurately.

- Proceed to the section where you must provide specific details related to the purpose of the form. Ensure that all information is clear and precise.

- Complete any additional fields or sections that pertain to your situation. Take your time to read through the instructions provided with the form as they can offer valuable insights.

- Once you have filled out all sections, review your information for accuracy. It is essential to ensure that all data entered is correct before proceeding.

- Finally, you can save your changes, download the completed form, print it for your records, or share it as necessary.

Complete your TX 05-158-A form online today for a seamless document management experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing an amended Texas franchise tax return requires you to fill out the original form again, indicating the changes or corrections needed. It’s essential to include an explanation of the amendments for clarity. For assistance with the filing process, consider utilizing USLegalForms to simplify the experience while ensuring compliance with TX 05-158-A.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.