Loading

Get Treasury Fs 1522 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Treasury FS 1522 online

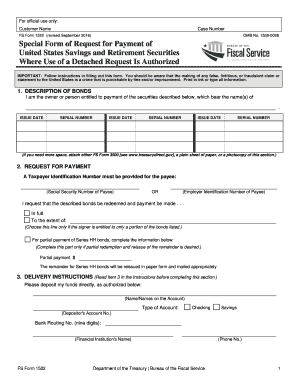

This guide provides step-by-step instructions for completing the Treasury FS 1522 online, a form used to request payment for United States savings and retirement securities. Whether you are a novice or familiar with financial documents, the following directions will assist you in navigating this process smoothly.

Follow the steps to fill out the Treasury FS 1522 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Description of Bonds' section, provide the name(s) of the individuals shown on the bonds along with their respective issue dates and serial numbers. If additional space is needed, attach a PD F 3500, a plain sheet of paper, or a photocopy.

- In the 'Request for Payment' section, select your payment option. Indicate whether you want the payment in full or in partial amounts. If partial payment for Series HH bonds is desired, specify the amount.

- Provide the taxpayer identification number (TIN) for the payee. If the payee is an individual, use their Social Security Number. If applicable, provide the Employer Identification Number of an entity.

- Fill out the 'Delivery Instructions' with the name(s) on the account, the type of account (checking or savings), the account number, the bank routing number, and the financial institution's name and phone number.

- In the 'Signature' section, the individual requesting payment must sign and print their name while providing their home address, daytime telephone number, and, if applicable, email address.

- Once all sections are completed, review the form for accuracy and clarity. Save your changes, and choose to download, print, or share the completed form as required.

Complete your Treasury FS 1522 form online today to ensure a smooth processing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, interest earned on TreasuryDirect accounts is taxable at the federal level. Under current tax laws, you must report this interest on your income tax return. However, many taxpayers enjoy the benefit of being exempt from state taxes, which makes Treasury bonds an attractive investment.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.