Get Tn Dor Bus 416 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

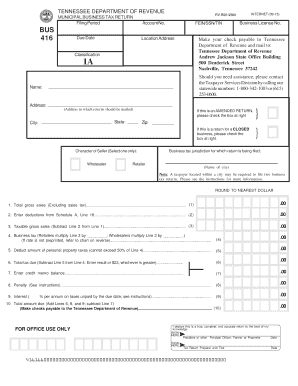

Tips on how to fill out, edit and sign TN DoR BUS 416 online

How to fill out and sign TN DoR BUS 416 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can turn into a significant hurdle and a major hassle if adequate help is not provided.

US Legal Forms has been developed as an online solution for TN DoR BUS 416 e-filing and offers numerous advantages for taxpayers.

Use US Legal Forms to ensure secure and straightforward filling of the TN DoR BUS 416.

- Obtain the template online in the respective section or through the search engine.

- Press the orange button to access it and wait until it finishes loading.

- Review the form and follow the instructions. If you have never filled out the template before, follow the step-by-step recommendations.

- Pay attention to the highlighted fields. They are fillable and require specific information to be entered. If you are unsure about what information to provide, consult the instructions.

- Always sign the TN DoR BUS 416. Use the built-in tool to create your electronic signature.

- Click on the date field to automatically insert the correct date.

- Review the sample to verify and edit it before submission.

- Click the Done button in the upper menu once you have finished.

- Save, download, or export the completed form.

How to modify Get TN DoR BUS 416 2015: tailor forms online

Maximize the use of our comprehensive online document editor while filling out your forms. Complete the Get TN DoR BUS 416 2015, highlight the most crucial details, and smoothly make any additional necessary changes to its content.

Filling out documents digitally is not only efficient but also provides the chance to modify the template to suit your preferences. If you are going to handle the Get TN DoR BUS 416 2015, think about finishing it with our all-encompassing online editing tools. Whether you have a typographical error or placed the required information in the wrong section, you can effortlessly make changes to the form without having to start over as required in manual completion.

Furthermore, you can designate the important information in your documents by accentuating specific sections with colors, underlining them, or encircling them.

Our powerful online tools are the superior way to complete and tailor Get TN DoR BUS 416 2015 according to your specifications. Utilize it to prepare personal or professional documents from anywhere. Open it in a browser, make any changes in your forms, and revisit them at any time in the future - they will all be securely stored in the cloud.

- Launch the form in the editor.

- Input the required data in the empty fields using Text, Check, and Cross tools.

- Follow the document navigation to avoid missing any essential sections in the template.

- Circle some of the pivotal details and add a URL to it if appropriate.

- Utilize the Highlight or Line options to underscore the most critical information.

- Choose colors and thickness for these lines to ensure your sample appears polished.

- Erase or blackout the details you wish to keep private.

- Replace content with errors and re-enter the information you require.

- Finish editing with the Done option when you are confident everything is accurate in the document.

Related links form

Filing business taxes late in Tennessee can result in penalties and interest on the unpaid amount. The specific penalties vary depending on how late the filing is, but they can become substantial over time. To avoid these potential issues, timely filing using the TN DoR BUS 416 resource can provide the necessary reminders and guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.