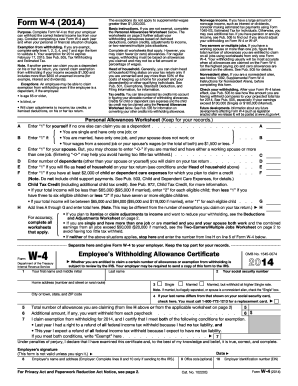

Get Irs W-4 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-4 online

How to fill out and sign IRS W-4 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Reporting your earnings and submitting all the essential tax documents, including IRS W-4, is a U.S. citizen’s sole responsibility. U.S. Legal Forms makes your tax handling much more clear and accurate.

You can obtain any legal forms you need and complete them digitally.

Keep your IRS W-4 secure. Ensure that all your relevant documents and records are organized while keeping in mind the deadlines and tax regulations established by the Internal Revenue Service. Simplify it with U.S. Legal Forms!

- Access IRS W-4 on your web browser from your device.

- Click to open the fillable PDF file.

- Start filling out the template field by field, following the instructions of the advanced PDF editor’s interface.

- Carefully enter text and figures.

- Click the Date box to automatically insert the current date or edit it manually.

- Use the Signature Wizard to create your personalized electronic signature and sign in moments.

- Refer to Internal Revenue Service guidelines if you have further inquiries.

- Click Done to save your changes.

- Proceed to print the document, download it, or share it through email, text messaging, fax, or postal mail without leaving your browser.

How to Alter Get IRS W-4 2014: Customize Forms Online

Completing documents is simple with intelligent online tools. Eliminate paper documentation with effortlessly downloadable Get IRS W-4 2014 templates that you can modify online and print.

Preparing documents and forms should be more straightforward, whether it is a routine aspect of one’s work or an occasional task. When someone needs to submit a Get IRS W-4 2014, reviewing regulations and instructions on how to properly fill out a form and what it should entail can consume a lot of time and effort. However, if you locate the appropriate Get IRS W-4 2014 template, finalizing a document will no longer be a struggle with a smart editor available.

Explore a wider range of features you can incorporate into your document processing workflow. No longer is it necessary to print, fill, and annotate forms by hand. With an intelligent editing platform, all essential document management functionalities will consistently be accessible. If you aim to enhance your workflow with Get IRS W-4 2014 forms, locate the template in the inventory, click on it, and uncover an easier method to fill it out.

If the form requires your signature or date, the editor provides tools for that as well. Reduce the likelihood of mistakes by utilizing the Initials and Date functions. It’s also feasible to incorporate custom visual elements into the form. Utilize the Arrow, Line, and Draw tools to modify the document. The more tools you are acquainted with, the easier it becomes to work with Get IRS W-4 2014. Try the solution that provides everything necessary to locate and edit forms in a single browser tab and eliminate manual paperwork.

- If you wish to insert text at any location in the form or add a text field, employ the Text and Text field tools to extend the text within the form as needed.

- Utilize the Highlight tool to emphasize the primary sections of the form.

- If you need to obscure or delete certain text segments, employ the Blackout or Erase tools.

- Personalize the form by introducing default graphic elements to it.

- If necessary, employ the Circle, Check, and Cross tools to integrate these aspects into the forms.

- For additional notes, leverage the Sticky note tool, placing as many reminders on the forms page as needed.

Get form

The purpose of IRS Form W-4 is to inform your employer how much federal income tax to withhold from your paychecks. This form helps ensure that you neither owe a large tax bill at the end of the year nor receive an unexpected large refund. By submitting a well-completed IRS W-4, you can effectively manage your tax liability and improve your financial planning.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.