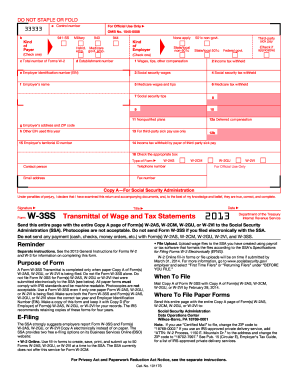

Get Irs W-3ss 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-3SS online

How to fill out and sign IRS W-3SS online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Registering your earnings and reporting all the important tax documents, including IRS W-3SS, is the exclusive responsibility of a United States citizen.

US Legal Forms simplifies your tax preparation, making it more accessible and accurate.

Keep your IRS W-3SS safe. Ensure that all your accurate documents and records are organized while remembering the deadlines and tax laws set forth by the IRS. Simplify it with US Legal Forms!

- Obtain IRS W-3SS in your web browser from your device.

- Access the editable PDF document with a click.

- Begin filling out the template section by section, utilizing the guidance of the advanced PDF editor's interface.

- Accurately input textual details and figures.

- Select the Date field to automatically set the current date or modify it manually.

- Utilize Signature Wizard to create your unique e-signature and sign in moments.

- Refer to Internal Revenue Service guidelines if you still have any inquiries.

- Click Done to save your changes.

- Proceed to print the document, save it, or share it via Email, text message, Fax, USPS without leaving your browser.

How to modify Get IRS W-3SS 2013: personalize forms online

Opt for a dependable document editing solution you can rely on. Alter, complete, and sign Get IRS W-3SS 2013 securely online.

Frequently, modifying forms like Get IRS W-3SS 2013 can be problematic, particularly if you acquired them online or via email but lack access to specialized software. Naturally, you can utilize some alternatives to circumvent this, but you risk obtaining a form that won't satisfy the submission criteria. Employing a printer and scanner isn’t a viable solution either, as it consumes time and resources.

We provide a more streamlined and productive method for completing documents. A wide variety of file templates that are simple to modify and authorize, making them fillable for others. Our solution transcends a mere collection of templates. One of the finest aspects of using our service is that you can modify Get IRS W-3SS 2013 directly on our site.

Being a web-based service, it saves you from the necessity of obtaining any software. Furthermore, not all corporate policies permit the installation of such software on your work computer. Here’s how you can easily and securely finish your forms with our platform.

Forget about paper and other ineffective methods for altering your Get IRS W-3SS 2013 or other forms. Instead, use our tool that merges one of the richest collections of ready-to-customize forms with a powerful file editing option. It’s simple and secure, and can save you a lot of time! Don’t just take our word for it, try it yourself!

- Click the Get Form > you’ll be promptly redirected to our editor.

- Once opened, you can commence the customization process.

- Select checkmark or circle, line, arrow and cross and other options to annotate your document.

- Choose the date option to add a specific date to your template.

- Insert text boxes, visuals and notes to enhance the content.

- Utilize the fillable fields option on the right to make fillable fields.

- Select Sign from the top toolbar to generate and create your legally-binding signature.

- Hit DONE to save, print, and distribute or obtain the output.

Get form

Related links form

You can obtain your IRS forms, including the IRS W-3SS, directly from the IRS website. Additionally, local libraries and post offices often stock these forms, helping you access them easily. For a more streamlined process, consider using services like USLegalForms which provide a user-friendly platform to get IRS forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.