Loading

Get Irs W-3pr 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-3PR online

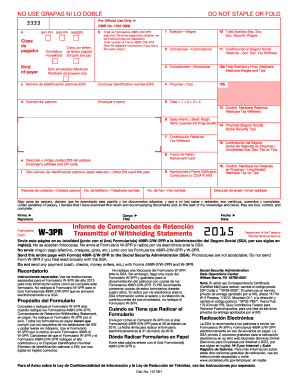

Filing the IRS W-3PR form online is an important step in reporting employee wages and withholding statements. This guide provides a comprehensive overview of the form's components and offers clear instructions for completing it effectively.

Follow the steps to successfully fill out the IRS W-3PR form online.

- Use the ‘Get Form’ button to obtain the IRS W-3PR form and open it in the editor for filling out.

- Begin by filling in the employer's identification number (EIN) in section 'c'. This number is crucial for identifying your business and ensuring accurate processing.

- Complete the employer's name in section 'd' and provide the address and ZIP code in section 'e'. Accurate information here is essential for proper delivery.

- Proceed to report the total wages for your employees in section '1'. This includes all applicable wages paid during the reporting period.

- Document any commissions, allowances, and tips in sections '2', '3', and '4', respectively. Ensure these figures are accurate and reflect all payments made.

- Calculate the total wages by summing the amounts entered in previous sections and recording this figure in section '5'.

- In section '11', list the total amount of Social Security tax withheld from employees' wages. This is an important component for tax reporting.

- Complete section '12b' with the total Medicare wages and tips. This should include all applicable payments.

- After filling in all required sections, ensure that the totals are accurate. Review all data before moving forward.

- Finally, save your changes, and choose to download, print, or share the IRS W-3PR form as needed to complete the filing process.

Complete your IRS W-3PR form online today to ensure timely and accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The W-8BEN form for non-U.S. individuals enables foreign persons to certify their non-resident status to avoid higher tax rates on U.S. sourced income. By completing this form, you can claim any applicable tax treaty benefits, which may lower withholding rates. Utilizing platforms like US Legal Forms can streamline this process and ensure you comply with IRS W-3PR guidelines.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.