Loading

Get Irs W-3pr 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-3PR online

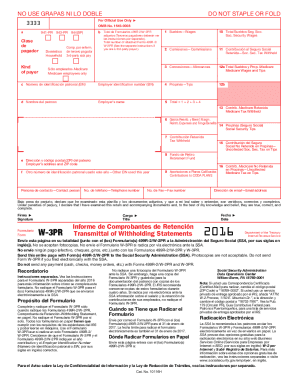

The IRS W-3PR is a crucial form for employers in Puerto Rico, used to transmit withholding statements to the Social Security Administration (SSA) along with Forms 499R-2/W-2PR. This guide provides a step-by-step approach to filling out the W-3PR online effectively and accurately.

Follow the steps to complete the IRS W-3PR online successfully.

- Click ‘Get Form’ button to obtain the IRS W-3PR form and access it in your preferred editing tool.

- Carefully enter the type of payer information in the designated field, choosing the correct classification based on your business operations.

- Fill in employer identification number (EIN) along with the employer’s name and address, ensuring all information is correct and matches the related W-2 forms.

- Complete the wage sections by entering total wages, tips, and withholding amounts as reported on your Forms 499R-2/W-2PR.

- Review the declaration section regarding the accuracy of the information provided and ensure it is signed by an authorized representative.

- Save your changes, and depending on your requirements, download, print, or share the completed form for submission.

Begin filing your IRS W-3PR online today to ensure compliance and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The primary difference between W-8BEN and W-8BEN-E lies in the type of entity each form targets. The W-8BEN is for individuals, while the W-8BEN-E caters to foreign entities. Each form serves the purpose of certifying foreign status to claim tax treaty benefits, but you'll need the correct one for your situation. To learn more, resources such as the US Legal Forms platform provide guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.