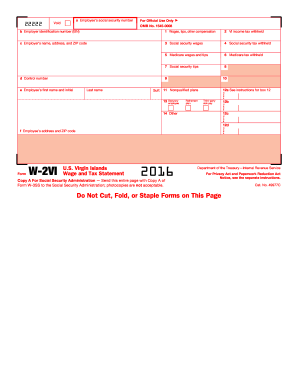

Get Irs W-2vi 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-2VI online

How to fill out and sign IRS W-2VI online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Documenting your earnings and providing all the necessary tax paperwork, including IRS W-2VI, is a requirement for US citizens. US Legal Forms simplifies your tax filing process, making it clearer and more effective. You can access any legal templates you need and complete them online.

How to complete IRS W-2VI online:

Keep your IRS W-2VI safe. Ensure that all your accurate documents and records are organized while keeping track of the deadlines and tax regulations established by the IRS. Make it easy with US Legal Forms!

- Obtain IRS W-2VI in your web browser from your device.

- Open the editable PDF file with a click.

- Begin filling out the template box by box, adhering to the guidance of the advanced PDF editor's interface.

- Accurately input text and numbers.

- Click the Date box to automatically set the current date or modify it manually.

- Use the Signature Wizard to create your customized e-signature and authorize in seconds.

- Consult the Internal Revenue Service guidelines if you have further inquiries.

- Select Done to save the modifications.

- Proceed to print the document, download, or share it via email, texting, faxing, or USPS without leaving your browser.

How to modify Get IRS W-2VI 2016: personalize forms online

Put the correct document editing tools at your disposal. Execute Get IRS W-2VI 2016 with our reliable tool that includes editing and eSignature features.

If you wish to finish and sign Get IRS W-2VI 2016 online effortlessly, then our online cloud-based solution is the ideal option. We offer a comprehensive template-based catalog of ready-to-use forms you can modify and complete online. Furthermore, you don't need to print the document or rely on third-party options to make it fillable. All essential features will be readily accessible for your use once you open the file in the editor.

Let’s explore our online editing capabilities and their main functionalities. The editor has a user-friendly interface, so it won't take much time to understand how to utilize it. We’ll review three primary sections that allow you to:

In addition to the aforementioned capabilities, you can protect your file with a password, apply a watermark, convert the file to the desired format, and much more.

Our editor makes it simple to complete and certify the Get IRS W-2VI 2016. It allows you to perform virtually everything regarding form management. Additionally, we consistently ensure that your experience in document modification is safe and adheres to the primary regulatory standards. All these aspects enhance the pleasure of using our solution.

Obtain Get IRS W-2VI 2016, implement the necessary edits and adjustments, and download it in your chosen file format. Test it out today!

- Alter and annotate the template

- The top toolbar includes features that assist you in highlighting and obscuring text, along with graphics and graphical elements (lines, arrows, and checkmarks, etc.), sign, initial, date the document, and more.

- Organize your documents

- Utilize the toolbar on the left if you want to rearrange the document or/and delete pages.

- Make them shareable

- If you aim to create a fillable template for others and distribute it, you can employ the tools on the right to add various fillable fields, signature and date, text box, etc.

Get form

Related links form

To retrieve an old IRS W-2VI, start by reaching out to your previous employer. They should maintain records of past W-2 forms for several years. If that route doesn't work, uslegalforms offers services that streamline the request process and can provide guidance on how to obtain your older W-2 documents with ease. This helps you stay organized and prepared for any tax obligations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.