Loading

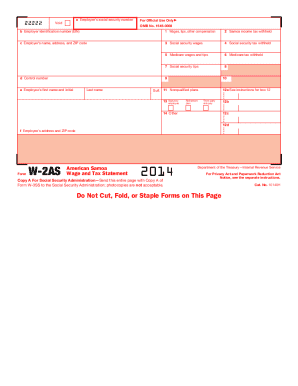

Get Irs W-2as 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2AS online

The IRS W-2AS, or American Samoa Wage and Tax Statement, is an essential document for reporting an employee's wages and tax withholding. This guide provides a comprehensive overview of how to accurately fill out the form online, ensuring you meet all necessary tax reporting requirements.

Follow the steps to effectively complete the IRS W-2AS online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the employee’s social security number in box 'a'. Ensure the number is accurate to avoid any issues with tax processing.

- In box 'b', enter the employer identification number (EIN)—a unique number assigned by the IRS to identify your business.

- Complete box 'c' with the employer's name, address, and ZIP code. Ensure that this information is current and matches IRS records.

- In box '1', report the total wages, tips, and other compensation received by the employee. This amount should reflect earnings for the tax year.

- Enter any Samoa income tax withheld in box '2'. This is crucial for tax calculations and potential refunds.

- In box '3', record the social security wages, which may differ from total wages due to non-taxable benefits.

- Fill in box '4' with the total social security tax withheld from the employee's wages.

- In box '5', report the total Medicare wages and tips. Ensure this includes all relevant compensation subject to Medicare tax.

- Document the Medicare tax withheld in box '6'. This should represent the 1.45% tax rate applied to Medicare wages.

- Enter any social security tips in box '7' if applicable.

- If there is a control number assigned by your employer, it should be entered in box 'd'. This is generally optional for most employees.

- In box 'e', provide the employee's first name, middle initial, and last name, ensuring accuracy to facilitate the correct processing of the form.

- Record the employee's address and ZIP code in box 'f'. This should reflect the current residential address of the employee.

- Fill out box '12' with any applicable codes and amounts related to retirement plans and sick pay, as per the instructions provided in the form.

- Once all sections are completed, review the information for accuracy and completeness before saving the document.

- Users can save changes, download, print, or share the completed form, ensuring they're prepared to file with the appropriate entities.

Complete your IRS W-2AS online today to ensure accurate and timely filing!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you need an old W-2, the most straightforward approach is to contact your former employer. They are obligated to keep records of your W-2 for several years. Alternatively, you can utilize the IRS W-2AS system, which may provide you with access to past tax forms. This feature can help you retrieve your documents quickly and effortlessly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.