Loading

Get Fl Fsa-dca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL FSA-DCA online

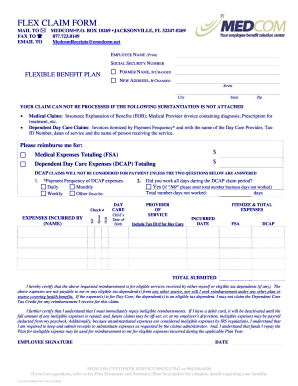

Filling out the FL FSA-DCA form is a crucial step in managing your flexible spending account benefits online. This guide provides a clear, step-by-step approach to ensure you complete the form correctly and efficiently.

Follow the steps to complete the FL FSA-DCA form online.

- Click ‘Get Form’ button to access the FL FSA-DCA form and open it for completion.

- Enter your full name in the 'Employee Name' field, ensuring accuracy for processing.

- Provide your social security number in the corresponding field, and include any former name if applicable.

- Input your new address, if changed, including street, city, state, and zip code.

- Attach the necessary substantiation documents. For medical claims, include an insurance explanation of benefits and a medical provider invoice. For dependent day care claims, submit itemized invoices with the required details.

- Indicate the total amounts for medical expenses and dependent day care expenses in the specified fields.

- Complete the required questions for DCAP claims regarding payment frequency and confirm your work status during the claim period.

- Itemize and total your expenses in the designated table, providing the name of the service provider, date incurred, and relevant expenses.

- Read and understand the certification statement regarding reimbursement eligibility and your signature confirming the accuracy of the information provided.

- Sign and date the form to complete your submission.

- Once filled out, save your changes, download, print, or share the form as necessary.

Complete your FL FSA-DCA form online today for efficient processing of your claims!

Related links form

The primary difference between FSA DC (Dependent Care) and FSA HC (Health Care) lies in eligible expenses. FSA DC is focused on child care costs, while FSA HC covers medical expenses related to healthcare. Understanding these differences ensures you make the best use of FL FSA-DCA for your family's needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.