Loading

Get Irs W-2as 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2AS online

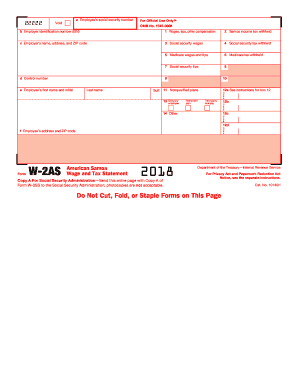

Filling out Form W-2AS, the American Samoa Wage and Tax Statement, is essential for accurately reporting employee wages and taxes withheld. This guide provides a step-by-step approach to completing the form online, ensuring users understand each component involved in the process.

Follow the steps to successfully fill out the IRS W-2AS online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employee’s social security number in the designated field labeled 'a'. This is crucial for accurate reporting.

- In field 'b', provide the employer's identification number (EIN). This identifies your business for tax purposes.

- Fill in the employer's name, address, and ZIP code in field 'c'. This helps establish the employer's location.

- Report total wages, tips, and other compensation in box 1. This reflects what the employee earned over the year.

- Indicate the amount of Samoa income tax withheld in box 2, ensuring proper tax reporting.

- List social security wages in box 3 and report social security tax withheld in box 4; these figures are vital for social security benefit calculations.

- Total Medicare wages and tips should be filled in box 5, followed by the amount of Medicare tax withheld in box 6.

- If applicable, enter the amount of social security tips in box 7.

- Utilize boxes 11 to 14 for entering other specific details regarding retirement plans, nonqualified plans, and other relevant information as needed.

- Finally, after thoroughly reviewing all entries for accuracy, users can save changes, download, print, or share the completed form.

Complete your forms accurately and efficiently online to ensure compliance and ease of record-keeping.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To enter two W-2 forms on TurboTax, use the software's W-2 input screen. You can input details from each form separately, allowing TurboTax to aggregate the income and deductions automatically. This method ensures a smooth filing experience, especially when managing multiple IRS W-2AS forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.