Loading

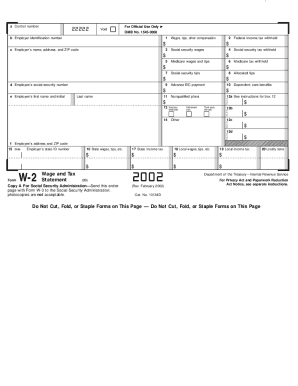

Get Irs W-2 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2 online

Filling out the IRS W-2 form online can seem daunting, but with a clear understanding of its components, you can efficiently complete it. This guide will walk you through each section of the form, ensuring you have all the information needed for a correct submission.

Follow the steps to accurately complete your IRS W-2 form online.

- Click 'Get Form' button to obtain the W-2 form and access it in an editable format.

- Begin by filling in the employer identification number in box b, ensuring it's accurate as it identifies your employer.

- In box 1, enter the total wages, tips, and other compensation you received during the tax year.

- Move to box 2 and enter the amount of federal income tax that was withheld from your wages.

- Fill in the employer's name, address, and ZIP code in box c, ensuring it matches the details provided by your employer.

- Report your social security wages in box 3 and any social security tax withheld in box 4.

- In box 5, input your Medicare wages and tips, followed by the Medicare tax withheld in box 6.

- Record any allocated tips in box 8 and advance earned income credit payments in box 9.

- For dependent care benefits, fill in box 10 with the total benefits your employer provided.

- Complete box 11 if applicable, indicating any nonqualified plans.

- In box 12, use the appropriate code to report any other benefits or adjustments.

- Enter your personal information, including your social security number in box d and your name in boxes e and f.

- For state taxes, fill in boxes 15 through 20, detailing your state wages, state income tax, local wages, and local income tax.

- Once all sections are completed, you can save changes to your document, download the form, print it, or share it as necessary.

Start your document management journey by completing your IRS W-2 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain an old IRS W-2, contact your previous employer directly and request a copy. Most employers keep records for several years and can provide a duplicate upon request. If you can't reach your former employer, you can also obtain your W-2 from the IRS by filing Form 4506-T. Uslegalforms can assist you in understanding this process further.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.